Forex news from the European trading session - 1 Feb 2018

Join the conversation in our new Telegram group

News:

- Keeping up with the crypto-lingo, here's what you need to know

- Will February be a good month for Bitcoin?

- MAS says they are watching developments in the cryptocurrency space

- UK's May wants EU citizens arriving in UK during transition period to have different rights

- Russia's Nabiullina doesn't rule out rate cut at 9 Feb meeting

- Brexit minister Davis hoping not to have EU laws harm UK during transition period

- FX option expiries for the 15.00 GMT cut - 1 Feb 2018

- EUR/CHF looks to have stemmed the rot at the first time of asking

- UBS forecasts that the BOE will hike rates by May this year

- Cable continues to shoot for the stars

- Australian MP David Feeney resigns from parliament - report

- Cracks are starting to show in the AUD/USD foundation

- Look out for the 4 A's in trading today

- Sterling and euro gains as the dollar loses some ground

- PBOC lends a total of 25.4bln yuan via SLF in Jan

- Yields continue to rip higher on the day

- Trading ideas for the European session

- Nikkei 225 closes higher by 1.68% at 23,486.11

- ForexLive Asia FX news: Subdued ranges in Asia

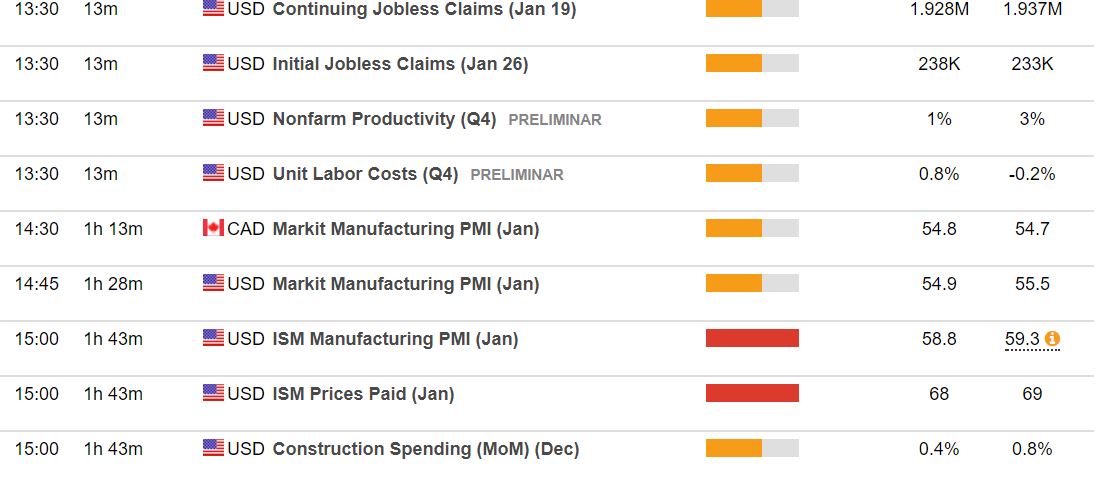

Data:

- Eurozone January final manufacturing PMI 59.6 vs 59.6 prelim

- Germany Markit Jan mftg PMI final 61.1 vs 61.2 exp

- France January final manufacturing PMI 58.4 vs 58.1 prelim

- UK January manufacturing PMI 55.3 vs 56.5 expected

- Italy Markit Jan mftg PMI 59.0 vs 57.4 prev

- UK Jan Nationwide house price index m/m +0.6% vs +0.1% expected

- Spain Jan Markit mftg PMI 55.2 vs 55.7 expected

- Switzerland January manufacturing PMI 65.3 vs 64.0 ex

- Switzerland December retail sales y/y +0.6% vs -0.2% prior

- Switzerland January SECO consumer confidence +5 vs +2 expected

- Australia Jan commodity prices (SDR terms) y/y -0.6% vs -5.9% prior

- Japan January vehicle sales y/y -5.7% vs -1.0% prior

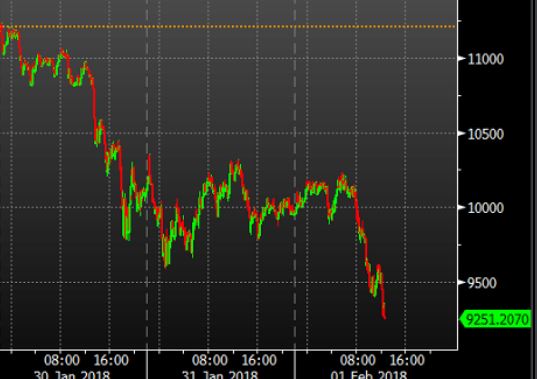

A lively start to a new month with Bitcoin tumbling, GBP rising rapidly then retreating and EURUSD once again bound by option expiry interest.

Running out of time for full summary but it's all in the posts above. Here's the p/a summary:

- Bitcoin down 9% to 9165 from 9600 on Bitstamp

- GBPUSD up to 1.4275 from 1.4180 then down to test 1.4200 again

- EURGBP down to 0.8716 from 0.8735 then back to test 0.8760

- EURUSD up to 1.2460 from 1.2385 then holding 1.2430

- USDJPY steady rally from 109.20 then caught in the cross-play crossfire and mainly 109.60-70

- AUDUSD continued its Asian slide from 0.8060 to post lows of 0.7987

- USDCAD range bound 1.2300-30

- NZDUSD ranging 0.7340-70

- Gold down to $1338 from $1345

- Oil in steady rally WTI $65.40 from 64.60

Data/event risk coming up: