Forex news for the European morning trading session 23 Nov 2017

Happy Thanksgiving to our US readers

News:

- SPD's Schulz calls a leadership meeting today at 16.00 GMT

- Reports circulating that Germany's SPD leader Schulz will resign today

- EU's Juncker: Can't say whether enough progress has been made in Brexit talks

- Italian economy could grow above 1.5% in 2017

- Forex option contract expiries for today 23 Nov

- Chinese equity markets taking a thumping

- Trading ideas for the European session

- ForexLive Asia FX news wrap: yen a small mover

Data:

- UK revised Q3 GDP qq 0.4% vs 0.4% expected

- Germany Q3 GDP final qq SA 0.8% as expected

- UK CBI Nov reported retailing sales 26 vs 3 exp

- Eurozone Markit Nov mtg PMI flash 60.0 vs 58.2 exp

- Germany Markit/BME Nov mtg PMI flash 62.5 vs 60.4 exp

- France Markit Nov mtg PMI flash 57.5 vs 55.9 exp

- China Oct revised trade balance USD 38.18bln vs 38.17bln prelim

An orderly session that's seen the euro extend gains as hopes of a German coalition deal rise and the US dollar remains on the back foot post-FOMC. Euro bulls also hoping to get a positive reading from the ECB Minutes due at 12.30 GMT

USDJPY has remained near Asian lows 111.07 , failing to get back above 111.30 while USDCHF has given up on defence of 0.9800 to post 0.9795 from 0.9820. USDCAD has also extended losses first begun two days ago on large option expiries and now been down to 1.2673 from 1.2710.

EURUSD has made steady progress from 1.1825 to test 1.1850 offers/res but found the level a tough nut to crack so far. EURGBP has posted 0.8909 from 0.8900 but fallen back a little as GBPUSD rallies to 1.3312 from 1.3283 lows having fallen from 1.3330. Better UK CBI retailing data helping the recovery.

EURUSD underpinned but sellers poised

EURJPY has rallied from 131.50 to test 131.80 but falling back as I type. AUDUSD found a base around 0.7610 and been up to 0.7639 while NZDUSD moved up from 0.6875 to 0.6906 before finding fresh supply.

Equities opened wobbly after Chinese stock markets suffered large losses but the DAX has led the way higher as hopes of a deal in Germany rise.

Oil steady while gold had a lift up from $1288 to $1294 before levelling out as equities firmed.

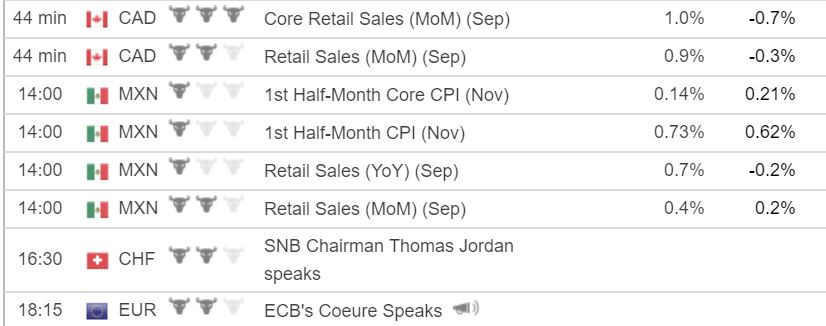

US markets closed for Thanksgiving but we do have Canadian retail sales on the horizon at 13.30 GMT and some CB talking heads in the mix.