Forex news for North American trading on February 12, 2021

- Dow, S&P and NASDAQ close at record highs

- CFTC commitments of traders. EUR and GBP longs increased. JPY longs trimmed

- Some key events and releases next week

- WTI crude oil futures settle at $59.47

- Draghi official accepts post as Italian prime minister

- Bitcoin bounces near its 100 hour moving average keeping the bullish bias

- Baker Hughes oil rig count up 7 to 306

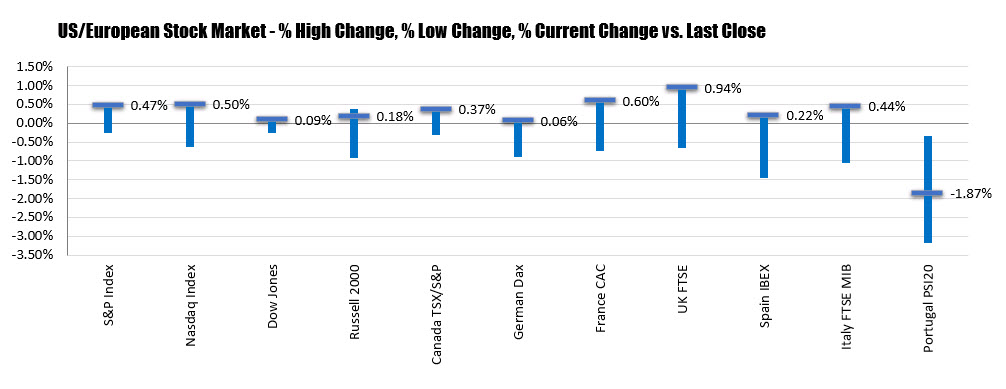

- European shares end higher. The weeks changes are mixed

- Canada approves North America's bitcoin ETF

- People are being re-infected with the new covid variant

- Sunak: G7 agreed international solution on digital tax a key priority

- US Feb UMich prelim consumer sentiment 76.2 vs 80.9 expected

- Aso: G7 finance ministers and central bank governors had call

- US 30-year bonds are having another look at 2%, helping to lift USD

- Canada December wholesale sales -1.3% vs -1.7% expected

- U Mich sentiment tops the North American economic calendar ahead of long weekend

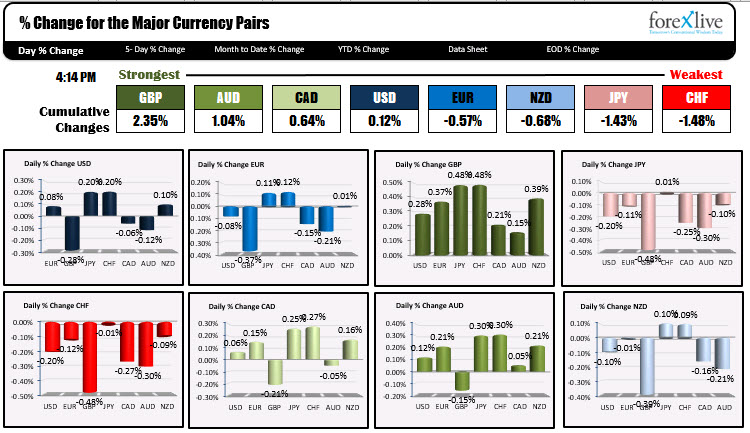

- The USD is the strongest and the NZD is the weakest as NA traders enter for the day

The US 30 year bond is closing the day - and week - above 2% for the first time in a year (since February 20, 2020). The yield is up on fears about potentially future inflation from higher growth. The Fed members - including Fed Chair Powell - continue to signal that tightening is not in the cards given full employment is still a ways away.

While 30 year yields moves to new new cycle highs, the 2 year yield moved to all time new lows this week at 0.972% (during yesterday's trading) before bouncing. Today the yield is going out near unchanged at 0.109%. If the Fed is on hold, there is not much pressure to push up yields in the short end.

The US stock market continues to give hope to a recovery in 2021. The three major indices all closed at record highs again today (and closed near highs as well). The gains were led by the Nasdaq index which rose by 0.50%. The S&P was not far behind at 0.47%. The Russell 2000 index which is leading the charge to the upside in 2021 so far with a gain of 15.93%, also led the charge this week with a gain of 2.51%. The Dow was the laggard with a gain of 1%. Below is a summary of the day's activity in North American and Europe.

In the forex market today, the GBP is ending as the strongest of the majors, while the CHF is the weakest. The USD is ending in the middle of the pack for the majors with gains vs the JPY and CHF (0.20%, the NZD (+0.10%) and the EUR (+0.08%). The greenback fell vs the GBP (-0.28%), the AUD (-0.12%) and the CAD (-0.06%).

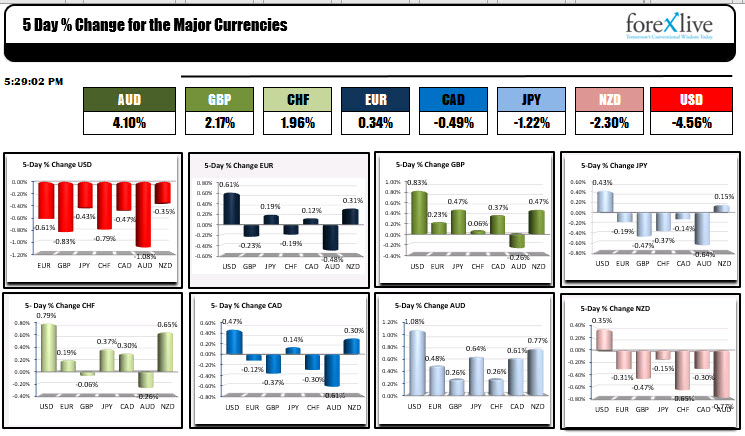

The strongest currency for the week was the AUD followed by the GBP, while the USD was the weakest. The USD fell -1.08% vs the AUD which was the biggest currency pair move this week.

In other markets this week:

- Bitcoin close last Friday at $37,860. The high price today reached $48,912 before settling at $47,947. The gain of $10,087 was good for a 26.6% gain for the week.

- Spot gold last week close at $1814 and close at $1824.23 for a gain of about $10 or 0.6%. The high for reached $1855. That also happened to stall right against its 200 day moving average.

- WTI crude oil futures close last week at $56.85. The high today reached $59.73 before closing at $59.47. The gain of $2.62 represents a percentage gain of 4.6% for the week.

Wishing you all a happy and healthy weekend. Thank you for your support.