Forex new for trading on November 13, 2017.

- An up and down day for US stocks. Major indices end higher.

- CFTC Commitments of Traders: JPY shorts rise to highest since Jan 2014

- 10 year yield back above 2.40%

- Crude oil futures settle at $56.76 per barrel

- US monthly budget statement for October -63.2B vs. -58.0B estimate

- Even more Kuroda: Unless there is another shock, we expect inflation to reach 2%

- BOJ Kuroda: Sees no significant problem with cryptocurrencies at the moment

- Bitcoin technical analysis: Tumbles but recovers. Intraday support being tested now.

- BOJ Kuroda: BOJ is pursuing powerful monetary easing

- UK Davis to Parliament: UK lawmakers will have a vote on Brexit deal

- AUDUSD falls to lowest level since July 11th

- Stocks in Europe end the day with losses

- NY Fed consumer inflation expectations one year ahead 2.6% vs 2.5% last month

- Philly Fed survey sees Q4 GDP at 2.6% vs 2.3% previously

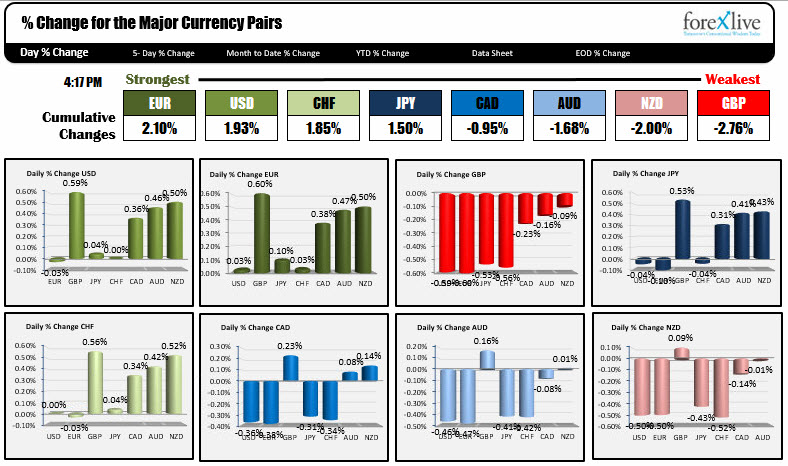

- The CHF is the strongest currency and GBP is the weakest as NA trader enter

- ForexLive morning news wrap: Pound pressure and yen demand the highlights

In other markets a snapshot of levels near the close show:

- Spot gold up $2.30 or +0.18% at $1277.76

- WTI crude oil futures are ending little changed at $56.72

- US yields are mostly higher: two-year yield 1.6829%, +2.8 basis points. Five-year yield 2.0749%, +2.3 basis points. 10 year yield 2.407%, +0.7 basis points. 30 year yield 2.875%, -0.4 basis points.

- US stock indexes reversed earlier losses and closed higher. S&P index rose by 2.54 points or +0.1%. NASDAQ composite index rose by 6.65 points or +0.10%. Dow industrial average increased by 17.5 points or +0.07%.

It was a quiet Monday in the North American trading session. Canada was on holiday for Remembrance Day and the US traders seemed to have a hangover from a weekend.

There is little in the way of economic data. The only release in the US was the monthly budget statement. The deficit rose by a greater than expected US$-63.2 billion versus US$-58.0 billion estimate. As usual the data had limited impact.

Bank of Japan's Kuroda spoke in Zürich. His comments were in line with the party line expressed over the last decade. He expects inflation to reach 2% by fiscal year 2019 and the Bank of Japan is pursuing powerful monetary easing.

Looking at the strongest and weakest currencies,, the EUR and the USD were the strongest currencies, while the GBP was the weakest. The USD got a little boost from a rebound in yields. The ten year note earlier today reach a level of 2.368%, but saw the yield rebound higher into the close at 2.407%. Staying above 2.40% will have traders eyeing the October high of 2.47%.

The EUR benefited the most from a rise in the EURGBP. Traders became more concerned about Brexit and the expectations that PM May can even survive. Nevertheless, although the weakest currency today, in the North American session, the declines were retraced a bit.

Technically what is sticking out?

For the EURUSD the pair spent most of the NY session trying to push above the August 2017 swing low at 1.1661, the October 6th swing low at 1.1668 and the line connnecting those two low levels which formed the neckline for a head and shoulders formation on the daily chart at 1.1673. The high price today reached 1.16749, but stalled. We are closing at 1.1665. A move above the 1.1673 should solicit more buying.

The USDJPY traded above and below its 100 hour MA line at 113.577 over the last 6 hours of the trading day. There was also a trend line a few pips higher. The inability to move away suggests the buyers and sellers are not too sure what it wants to do. We are ending the day above both the 100 hour MA and the trend line at 113.61. Are the buyers trying to make a play into the new day?

The GBPUSD moved higher of lower level in the NY session but stalled right at the 100 hour MA at 1.3136. The 200 hour MA is at the same level. That level was rejected on the test. On the downside the 100 day MA comes in at 1.3110. The sellers took the price well below that MA line in the London morning session (the low reached 1.30608) but could not keep the momentum going. The pair is closing just above that MA at 1.3115 (currently at 1.3110).