Forex news for North American trading on August 14, 2020.

- NASDAQ lower for the 1st time in 3 sessions

- CFTC commitment of traders: EUR longs increase to 200K (all time largest long position).

- Saudi public investment fund exits stakes in major companies

- Fed's Kashkari: US needs to shut down US to beat the coronavirus

- US postal services warns 46 states that some mailed ballots may not arrive in time to be counted for election

- Crude oil futures settle at $42.01

- CDC US Covid statistics for the day. 52,799 new cases

- China ramps up US oil purchases ahead of review of trade deal

- Silver spills lower and gold slips to the lows of the day

- Trump touts direct payments to Americans

- European shares end the lower on the day but rebound off days lows

- UK virus cases rise 1441 -- highest since June 14

- Fed's Kaplan sees Q4 GDP up 6-7% at annualized pace

- US business inventories -1.1% vs. -1.1% estimate

- August preliminary U Mich US consumer sentiment 72.8 vs 72.0 expected

- US July industrial production +3.0% vs +3.0% expected

- US July advance retail sales +1.2% vs +2.1% expected

- Canada manufacturing sales for June 20.7% vs. 16.4% estimate

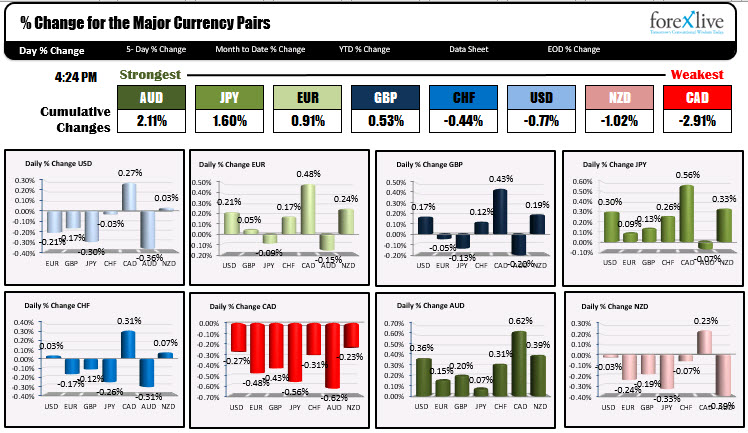

- The GBP is the strongest and the NZD is the weakest as NA traders enter for the day

In other markets:

- Spot gold is down $8.90 or 0.46% $1944.86

- Spot silver is down $1.02 or 3.73% $26.48

- WTI crude oil futures are down $0.03 or -0.07% at $42.21

In the US debt market today, yields are ending the day mixed. The 30 year bond still has some digestive problems it seems after the bad auction yesterday. It is up by 1.8 basis points at 1.445%. The other parts the yield curve are down modestly.

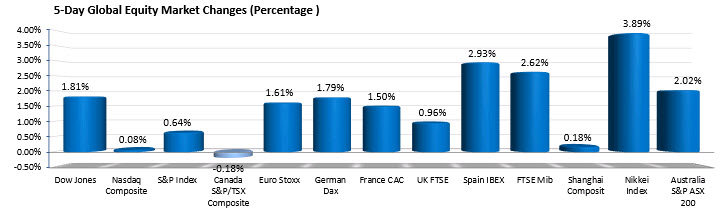

US stocks muddled through an up and down session and ended the day mixed. The broad US indices eked out a small gains in the US this week, with the Nasdaq basically unchanged and the S&P up 0.64%. The Dow led the way with a gain of 1.81%.

In Europe today, the major indices closed the London session lower but they outperformed this week. The Spain's Ibex was up 2.92% and Italy's FTSE was up 2.62%. Of course they each have a lot of catching up to do. They are down -25% and -14.8% respectfully for the year. The FTSE 100 (-19.26%) and France's CAC (-16.98%) are not exactly lighting the world on fire either. The Nasdaq (up 22.81%) and S&P (up 4.4% YTD) are far outpacing Europes results. Even the Dow at -2.13% is looking good in comparison.

In the forex market today, the USD is ending the day mixed/marginally lower. The commodity currencies were mixed with the greenback higher vs the CAD, down vs the AUD and unchanged vs the NZD. Against the GBP and the JPY the dollar ended the NY session little changed from early NY levels after seeing the dollar go lower and back higher by the close. The EURUSD move lower in the NY session by about 0.20%. (or 25 pips).

Economically today, although the retail sales headline number came in weaker than expectations at 1.2% vs. 2.1%, analysts noted that Amazon's prime day did not happen this year which may have slowed sales. Retail sales ex auto, ex auto and gas as well as the control group were better than expectations as were the revisions. Although numbers are for July, the focus will remain on the road ahead as the failure to pass him a new stimulus bill, and Covid concerns into the fall could lead to a slower economy. The good news is stimulus remains strong and those that are in the stock market, continue to do well.

Thank you for all your support this week. Wishing you all a happy and healthy weekend.