Forex news for US trading on January 19, 2016:

- Bank of England's Carney: Now is not the time to raise rates

- More from Carney: China slowdown will impact global growth and inflation for some time

- BOE's Carney offers little hope to the hawks

- China Securities Journal: China should cut RRR, raise deficit

- European banks lack capital buffers, ECB reviewing bad loan guidelines

- Banque of France's Villeroy: French/European recoveries are confirmed

- NAHB homebuilders index for January 60 vs. 61 estimate

- New Zealand Fonterra GDT auction price index -1.4% vs -1.6% prior

- November 2015 Canadian international securities transactions 2.58bn vs 22.08bn prior

- Gold down $1.45 to $1086

- WTI crude down $1.00 to $28.42

- S&P 500 up 3 points to 1882

- US 10 year yields up 1 bps to 2.05%

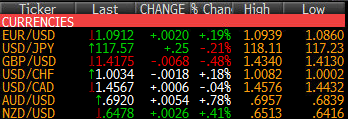

- AUD leads, GBP lags

Carney was the big story of the day as he reiterated what was first tipped a month ago when Weale shifted to the dovish side. Cable had been climbing higher in Europe to 1.4310 but was smashed down to 1.4129 in early US trading. It then staged a slow recovery before running into offers at 1.4200 and finishing near 1.4175.

Positive sentiment was the story early but it was sapped by another decline in oil. USD/JPY climbed to 118.10 but peaked as the US arrived. Stock futures were optimistic but disappointed right from the outset and eventually fell into negative territory until the China headline sparked a late recovery. USD/JPY fell to 117.57 early, bounced to 117.90 then slipped down 117.30 before a climb to 117.58.

EUR/USD is benefitting from risk aversion and the idea that the ECB can't afford the strain on its credibility that would come from switching back to promising more stimulus. EUR/USD started at 1.0870 in US trading and climbed to a session high of 1.0939 after a minor wedge broke. It then settled back to 1.0909.

USD/CAD looked to finally stage some kind of recovery as oil rallied above $30 early. The pair fell to 1.4432 early and then turned around with oil and is near flat and battling for a 13th consecutive gain at 1.4561.

AUD/USD was the top performer, although it didn't get a lift from the late China headline. The pair made its move in Asia and peaked at 0.6957 as NY arrived. It tracked as low as 0.6904 late and finishes near 0.6920.