Forex news for North American trade on September 19, 2017

- Breaking news. A record close for the S&P and Dow.

- Trump denies he warned Saudi Arabia against taking military action against Qatar

- Republican donors are paying Trump's legal bills - report

- Forex technical analysis: AUDUSD trades near highs, but lots of ups and downs in NY session

- FOMC preview: What to watch for in the dot plot (and what it means for the dollar)

- Trump warned Saudi Arabia and UAE against taking military action against Qatar - report

- Forex technical analysis: USDMXN little changed after earthquake.

- Powerful earthquake hits Mexico City

- Bitcoin technicals: Continues to stall near 200 hour MA

- France's Macron: Renouncing the Iran agreement would be a grave error

- Hurricane Maria draws closer to Puerto Rico as Category 5 storm

- Steve Beckner on Wednesday's FOMC meeting

- European stocks end session with modest gains

- Atlanta Fed GDPNow 3Q estimate for growth unchanged at 2.2%

- Economists still mostly believe the Fed will hike in December

- Sen Bob Corker: Tax cut decision may come today

- Still no signs of wage inflation

- Trump at UN: Venezuela is 'completely unaccetable' and we cannot stand by

- New Zealand GlobalDairyTrade price index +0.9% vs +0.3% prior

- Trump at the UN: If it's forced to defend itself or its allies, it will obliterate North Korea

- QE heavyweights: How much the ECB owns compared to the Fed

- Canada posts smaller-than-expected deficit in 2016-17

- Boris Johnson may resign before the weekend -- report

- US current account balance for 2Q -$123.1b vs -$116.0b estimate

- US housing starts for August 1180K vs 1174K estimate

- August US import price index +0.6% vs +0.4% expected

- Canada July manufacturing sales -2.6% vs -1.9% expected

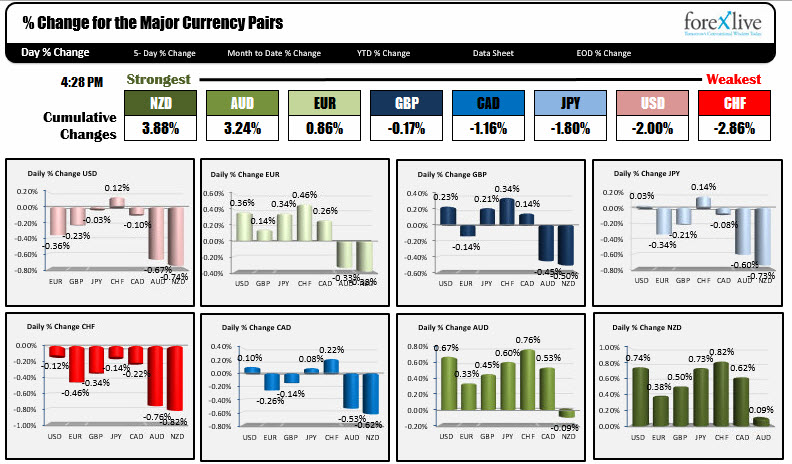

- AUD and NZD are the strongest. CHF is the weakest as NA trader enter for day

In other markets, a snapshot shows:

- WTI Crude down -$0.07 to $49.85. Crude stocks at the end of day showed a smaller than expected build.

- Spot gold is move up about $3.00 to $1310.67

- US major stock indices each closed at record levels but with modest gains. The S&P index is ending up 2.78 points or 0.11%. The Nasdaq is ending up 6.68 points or +0.10%. The Dow is up 39.45 points or +0.18%

- US yields are ending the session modestly higher. 2 year 1.401%, up 0.6 bo. 5 year 1.8357%, up 1 bp. 10 year 2.2446%, up 1.59 bp. 30 year 2.8144%, up 1.6 bp

The dollar seemed to be interested in buying some time today as the FOMC decision, statement, dot-plot, central tendencies, press conference is forthcoming tomorrow starting at 2 PM ET/1800 GMT. All that Fed stuff certainly beats the economic data released today including US import/export prices, US housing starts and building permits, US current account deficit.

No offence to those releases, but the Fed tomorrow will give the market a clearer vision of the start of the balance sheet reduction program. They will also give a view of the dot plot for rates - most specifically if the Fed is leaning to a December tightening (read Adam's post here). If the Fed signals one more to go with two meetings left, the dollar can go higher.

So with that kinda stuff "Coming Soon" (like tomorrow), the market spent a lot of the NY session waffling up and down in the major currency pairs. \

At the end of the day, the green back was a bit lower vs the major pairs, but most of those declines was vs the AUD and the NZD (the US dollar fell -0.67% and -0.74% respectively against each). For the AUD, most of it's gains occurred in the Asian and early European session. See post on the AUDUSD technicals here.

For the NZD, it got a little extra boost by a rise in the Global Dairy Trade auction rise of 0.9% (vs 0.3% at the last auction).

In other pairs, the EURUSD pair rose 0.36% on the day. In then NY session the pair moved higher in the Asian session, corrected back toward the closing level from yesterday in the London session, but moved back higher after holding support near the 50% midpoint of the last 3-plus weeks of trading at 1.19573. With the 200 hour MA near that level at 1.1963, that area will be a barometer for bullish above and bearish below in the new trading day (and through the Fed decision as well). The EURUSD had stalled twice at 1.2006 in trading today.

The USDJPY is ending the session near unchanged levels. It move up, down, up and down in trading today and technically, found support just ahead of the key 100 day MA at 111.117. That 100 day MA will continue to play a key bias role in the new trading day. The last three days have been able to close above that MA. The 200 day MA at 112.175 is on the path to the upside on more dollar buying. Keep that level in mind over the next 24 hours of trading.

The GBPUSD traded mostly between an area defined by highs from the post-Brexit trading in 2016. More specifically, the 1.34439 to 1.3532 area were swing highs in June 2016, July 2016 and September 2016. It wasn't until Friday last week, that those levels were retested and broken (on the GBPUSD's way to 1.3616-18 highs. Today the pair traded mostly between those levels in quiet up and down trading. In the new trading day, traders will be eyeing a break of either 1.34439 to the downside or the 1.3532 to the upside. Take your clues from the price action.

In the afternoon NY session, there was a report of a 7.1 magnitude earthquake in Mexico City, Early reports are that 54 people are reported to have died. People are urged to stay off the streets in the city. Many buildings have collapsed. Once again, thoughts and prayers go out to people effected by the natural disaster.

Below is a snapshot of the % changes of the major currencies vs each other.