Forex news for US trading on Dec 2, 2015

- US major indices end lower on the day

- Fed's Williams: Prefers liftoff sooner rather than later

- Saudi Arabia and Gulf states willing to cut oil output - BBG, citing WSJ (update: if non-OPEC cut too)

- It's an outside day now in the S&P 500

- Reports of at least 20 victims in San Bernardino, California shooting

- Three reasons US equities are sliding today

- WTI crude oil falls below $40, set for lowest close since August

- Fed's Beige Book: 'Many' districts said hiring pickup led by temp agencies

- Yellen Q&A: This may turn out to be a very different rate cycle

- OPEC unlikely to cut production if non-OPEC not cutting

- ECB said to present largely unchanged macroeconomic forecasts - BBG

- A closer look at Yellen's comments on inflation

- US Dollar Index touches highest since 2003 after Yellen speech (then reverses course)

- Dare you not believe in a Dec hike?

- Fed's Yellen: Labor market gains bolster her confidence on inflation

- Here's why I've cashed in my long held GBPUSD longs

- Closer look at Shana report shows why crude is at session lows

- US EIA crude oil inventories 1177K vs. -800K estimate

- Iran says majority of OPEC members agree to an output cut - Livesquawk

- VW to limit production at four German plants - Livesquawk

- Bank of Canada holds rates at 0.50%, as expected

- November 2015 US ISM New York 60.7 vs 58.0 exp

- Fed's Lockhart: Each FOMC meeting will be live after liftoff

- This is the definitely the best way to get out of a bad trade

- Further rise in USD is a risk to my outlook says Lockhart

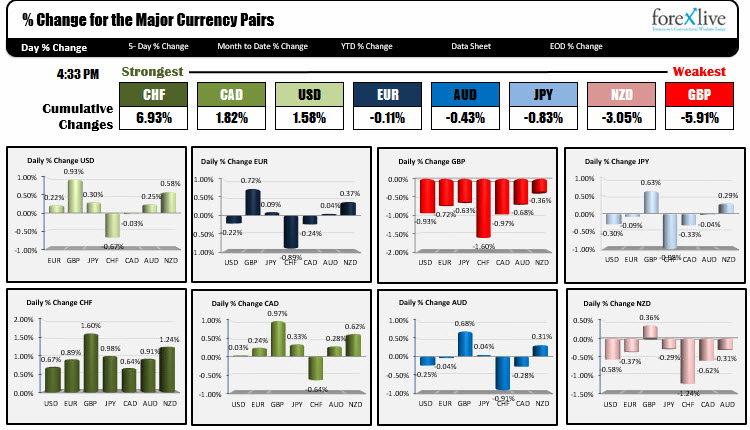

The NY session started quiet enough with the trading ranges confined. Fundamentally, the ADP employment report came in better than expected at 217K vs 190K estimate. Non Farm productivity rose to 2.2% from 1.6% (exp 2.2%). Labour costs were higher at 1.8% vs 1.1 estimate (1.4% preliminary). The dollar got a boost on the data. Fed's Lockhart was also on the wires with more hawkish statements including the December meeting my be "historic". Historic? A 25 basis point rise, maybe not. The historic significance of the length of time since the last change? I guess.

Later Chair Yellen spoke and although she did not explicitly say there was going to be a December tightening, the Chair - and the Fed - would certainly have a lot of explaining to do, if they did not. The dollar got another boost.

In Canada the BoC Canada left rates unchanged as expected.. The USDCAD rallied into the announcement and sold off after it. The CAD was further influenced by higher crude oil inventory data (+1.2M vs -800K est). There was also a report from Iran that OPEC agreed to an output cut. Then details surfaced, that Saudi Arabia and Gulf Arab countries would not support the cuts. Oil whipped around. The USDCAD whipped around. The USDCAD seemed happy to trade above and below the closing level until a late day selloff on afternoon dollar weakness.

The big price action was in the GBP. The pair was the weakest of the majors - falling against all. The GBPUSD trended lower for most of the trading day - taking out support levels one by one. The 1.5000 level stalled the pair for about an hour before giving way. The 1.4975 was a trend line support. Broken. The 1.4950 level was a swing low going back to January. Broken. The selling continued to and through the 1.4900 level before rebounding into the close. Some of the "mojo" came out of the trend day on the late day correction, but traders will still need to retake the always important 1.5000 level before declaring victory in stopping the bearishness.

The EURUSD was influenced by a large option expiration at 1.0600 for the early part of the NY session. The lower CPI in the European morning - and higher ADP employment - sent the pair lower, but dips seemed to find buyers who forced the price back toward 1.0600. Later, however, there was a move back down, and new lows going back to April 14th were made. The price stalled at 1.0550 and started to reverse after a report that the ECB would "present largely unchanged macroeconomic forecasts". HMMMM. Would that stop the ECB from easing tomorrow AM? That too would be a surprise. By the end of the day, the price had recovered and traded at NY session highs.

In other pairs, the USDJPY traded near the November highs at 123.74 (high reached 123.660) before reversing lower. The USDCHF ran out of upside momentum and fell below 100 hour MA, 200 hour MA and trend line support. Traders liquidating longs after the pair moved to new highs going back to August 2010 (last week).

ECB the key event tomorrow. The US employment report will be released on Friday..

Thoughts and prayers to victims of yet another random shooting. This one in California.