Forex news for US trading on November 20, 2015

- US stocks higher on the day. End week with solid gains

- CFTC Commitment of Traders report: Short positions increase in current week

- Add Chipotle to your "List of Fear"

- Key events and releases next week

- Baker Hughes rig count 564 vs. 574 last week

- And so ends a decent week for Europe's stock markets

- There's good news for the Swiss and Dutch from S&P

- Fed's Dudley: US economy will do ok

- November 2015 US KC Fed manufacturing 3 vs 4 prior

- Canada forecasts budget deficit of C$3billion for 2015-16

- More from Feds Bullard across newswires

- Forex technical analysis: Why is AUDUSD going higher?

- November 2015 Eurozone consumer confidence flash -6.0 vs -7.5 exp

- Bullard: US will go through another boom period

- Fed's Bullard says job creation may slow as US normalises

- Canada retail sales for September -0.5% vs. 0.1% exp

- October 2015 Canadian CPI 1.0% vs 1.0% exp y/y

- What does two opposing central bank moves mean for USDJPY and EURUSD?

Fed's Bullard and Dudley continued to hint at possible December tightening. Other than that the economic calendar was thin. So the market traded off flows, with perhaps some technicals thrown in.

The week is ending with the EURUSD reversing the short covering rally seen on Thursday. ECBs Draghi was dovish in his comments in the London morning session and the selling off those comments, continued in the US session. The pair is ending the week near the lowest close of the week at the 1.0641 level (from Tuesday). A week ago, the EURUSD closed at 1.0773 while in the midst of the Paris terrorist actions.

The GBPUSD was also weak today falling sharply during the European and NY sessions. IT is closing near/at low levels for the day. The 50% of the move up from the November low comes in at 1.5180 and there have been a number of swing lows between 1.5173 and 1.5186 going back to November 12th on the hourly chart. The pair is going out between these two levels after falling below the 100 hour MA, the 200 hour MA and trend line support.

The USDJPY did very little today in the NY session (20 pip range) . Technically, the pair stayed below the 200 hour MA at the 123.01 level (the high for the day reached 123.04 for the day).

The AUDUSD is closing the first time above the 100 day MA since June 18. The 100 day MA is at 0.7210.

The NZDUSD traded up and down today with no discernible trend. The USDCAD was supported by comments from the new Finance Minister Morneau who upon inspection of the books forecast a deficit for 2015 and slower growth.

Stocks ended the day and the week higher. The Nasdaq ended up 3.59%. The S&P was up 3.27%. The European stocks were led by German Dax up 3.84%. Australia S&P ASX index rose by 4.06%. Not a bad week for equities.

Next week is Thanksgiving week which means liquidity conditions will likely be light. For a look at the key events and releases CLICK HERE.

Have a great weekend...

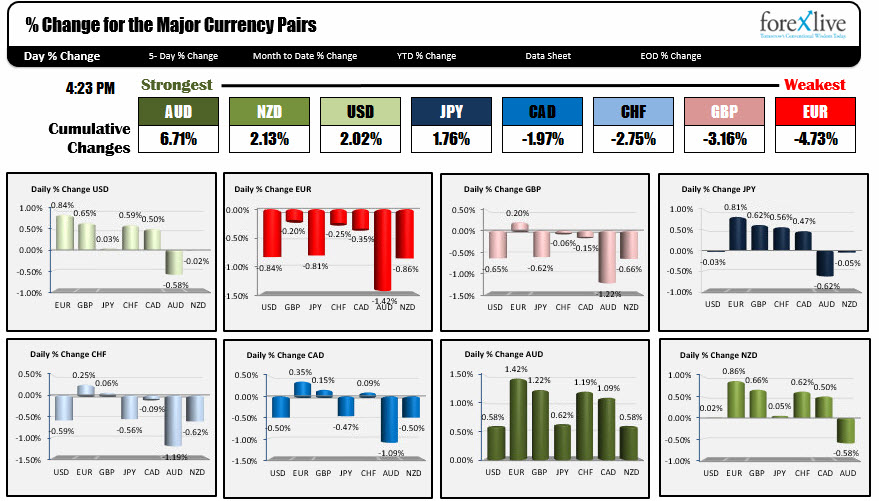

STRONGEST AND WEAKEST FOR TODAY:

The AUD was the strongest currency today, while the EUR brought up the rear. The greenback was higher against all except the AUD. It was little changed against the NZD and JPY and up the most vs. the EUR

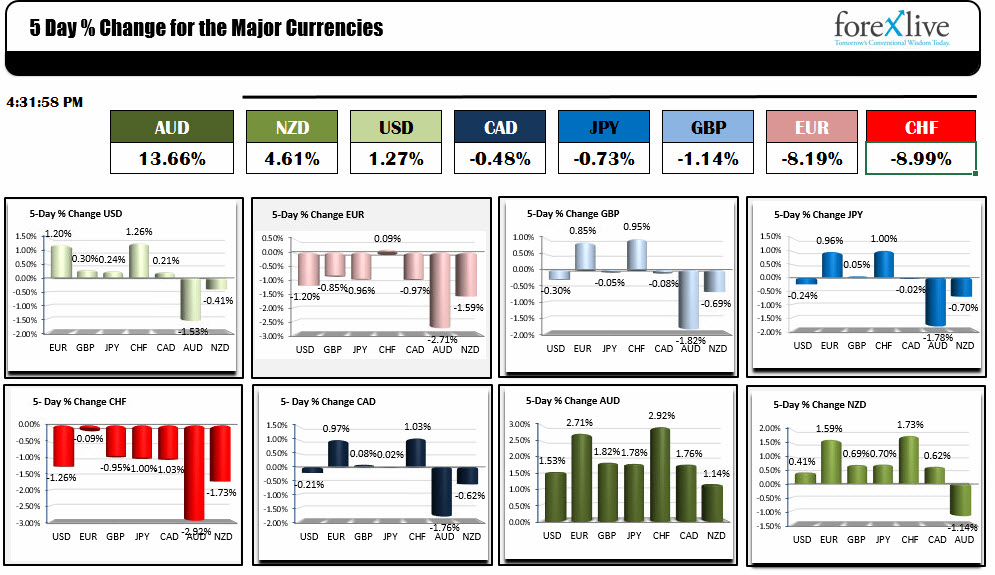

STRONGEST AND WEAKEST FOR THE WEEK:

Below are the changes of the major currencies vs. each other for the trading week. The AUD was the strongest - rising against all the major currencies. The CHF is the weakest as it fell against the majors. The USD was mixed on the week - rising against the EUR and CHF the most, falling against the AUD and NZD, and little changed against the GBP, JPY and CAD.