Forex news for New York trading on September 22, 2017:

- Theresa May: I'm proposing an implementation period under EU rules of around 2 years

- May Q&A: We're very close to a deal on protecting citizens in both UK and EU

- Canada retail sales for July 0.4% vs 0.2% estimate

- Canada August CPI +1.4% vs +1.5% y/y expected

- John McCain says he can't vote for Graham-Cassidy healthcare bill

- US Markit Manufacturing Sept PMI 53.0 vs 53.0 estimate

- Fed's George: Most recent Fed's proj make it appear at full employment

- Fed's Kaplan: Some of the inflation slowdown isn't transitory

- Kaplan says he's 'open minded' about December rate hike

- Kaplan Q&A: Oil industry in fragile equilibrium around $50 per barrel

- US Fed's Williams says he supports a gradual rise in interest rates

- Baker Hughes US oil rig count 744 vs 749 prior

- Trump and South Korea's Moon agree to enhanced deployment of assets

- EU's Barnier: Theresa May expressed "constructive spirit"

- New York Fed Q3 GDP Nowcast +1.6% vs +1.4% last week

- It would be "game-changer" if North Korea exploded H-bomb over Pacific - US official

- More from Fed's George: Feds forecast show confidence inflation will get to 2%

- Belgian consumer confidence -3.5 vs -2.1 in August

- Kuwait oil minister says will probably wait until next meeting to decide on extension

- OPEC ends meeting without recommendation on extension - report

- ECB's Constancio says wages not increasing more is am important puzzle in advanced economies

Markets:

- Gold up $6 to $1297

- WTI crude up 8-cents to $50.64

- US 10-year yields down 2 bps to 2.26%

- S&P 500 up 2 points to 2502, up 0.36% on the week

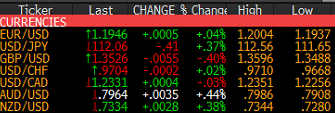

Theresa May's speech in Florence was highly-anticipated but failed to deliver anything beyond pleas for 'creativity' a dozen times. The lone highlight was extending the timeline by two years for a transitional period, where pretty much the same rules will apply. The market didn't like it and cable fell to 1.3488 at the lows but then bounced all the way back to 1.3570 but sagged again to finish at 1.3526 in a back-and-forth trade.

EUR?USD hit 1.20 in Asia but was already down to 1.1970 when New York arrived. The downward track continued after some selling into the London close. Last at 1.1945.

USD/JPY finished the day 40 pips lower but the damage was done well before US traders woke up. The pair was down as low as 111.65 but steadily (albeit slowly) tracked higher to 112.06. The market is evidently beyond the point of worrying about nuclear war.

USD/CAD jumped higher on disappointing inflation and weak details in the retail sales report. The pair climbed 50 pips on the headlines, retraced then caught a second wind in the latter half of the day in a climb to 1.2330.

AUD/USD, meanwhile, traded in a 20 pip range around 0.7670 without any real drama.

Have a great weekend.