FX news for NY trading on January 23, 2018.

- S&P and Nasdaq close at record levels.

- USDCAD trades to new session lows.

- Washington Post report Mueller wants to question Trump over Comey

- Heads up for oil traders - inventory data due at the bottom of the hour

- EURUSD survives the corrective fall. Is it ready to make a break higher? Or will fears of Draghi put a lid on it?

- Canada's Verheul: Hopeful US will show NAFTA flexibility

- Forex technical analysis: USDMXN runs lower on Trump comment, but stalls

- Pres. Trump: There will not be a trade war because of new tariffs

- Bitcoin trading back above 100 day MA. Can it stay above the key MA now?

- US auctions off $26 billion of two-year notes at a high yield of 2.066%

- Canada FM Morneau: Plan "A" is to have NAFTA improved

- European major indices mostly higher. France's CAC lags

- GBPUSD cracks below 1.4000 level and seeing some profit taking

- More from Fed nominee Goodfriend: Inflation is slowly rising. Fed on right path

- Barnier: UK still has to come up with Irish solution

- Fed nominee Goodfriend is getting grilled on Capitol Hill

- Eurozone Jan consumer confidence flash 1.3% vs 0.6% exp

- Richmond Fed manufacturing index for January 14 vs 19 expected

- DXY posts session lows as USD fragility continues

- The US stocks are opening with modest changes. Nasdaq doing the best.

- Natural gas futures up over 5%. Crude oil up about 1%

- Canada's PBO sees 2017-18 federal deficit at CAD 18.5bln

- USD wobbles again after weaker Philly Fed data

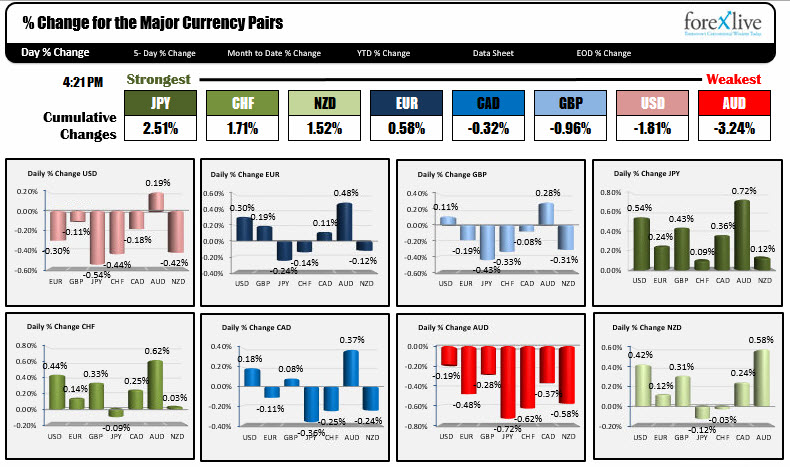

- The snapshot of the currency rank today shows the JPY is the strongest and the AUD is the weakest

A snapshot of other markets near the close is showing:

- Spot gold of $7.90 or 0.59% at $1341.51

- WTI crude oil futures of $.90 or 1.42% at $64.47

- S&P and NASDAQ composite index closed at record levels. The S&P rose 0.22%. The NASDAQ did much better at +0.71%. The Dow did not fare as well closing near unchanged levels for the day (it is so disappointing when a new high is not made).

- US treasury yields fell. The US treasury auction of $26 billion 2 year notes had stellar demand at the higher yield. 2 year 2.040%, -2 basis points. Five-year 2.415%, -3.2 basis points. 10 year 2.615%, -3.5 basis points. 30 year 2.897%, -1.6 basis points

- European stocks ended mostly higher. 10 year bond yields were mostly lower

The US dollar continued to slide in trading today and keep the trend heading to the downside.

The USDJPY moved back down toward the lows from last week at the 110.186 level. The low reached 110.246 at the bottom and is closing near that level.

The EURUSD also moved higher and is closing back toward a ceiling area at 1.2296. The high for the day extended to an intraday peak at 1.23056, but quickly retreated back toward a broken trend line on the hourly chart and held support. That give the buyers the upper hand, but with the ECB decision on Thursday followed by Draghi's presser, one has to wonder if the pair can go into that event at the highest levels since December 2014. If the pair is going lower, a move back below 1.2282 would be a close bearish intraday clue.

The GBPUSD traded to yet another 19 month high (any new high in the GBPUSD will be a new 19 month high until 1.5016) and in the process moved above the swing lows from April and June 2017 at 1.4004 and 1.4011 respectively. The high reached 1.40266 before correcting lower to 1.3962. At the close, the price has moved back to the 1.4000 level - and those old swing lows (at 1.4004-11). A topside trend line cuts across at 1.4033 (and moving higher) on the hourly chart (connecting highs this week).

The AUDUSD fell below the 100 hour MA in the Asian session and continued to the 200 hour MA. Buyers leaned against that MA, keeping the buyers/bulls in control. The price is ending the day near the 100 hour MA at 0.7994. A move back above will discourage the shorts.

The CAD was supported by higher oil, hope for NAFTA talks and a bearish bias lean in the USDCAD (higher CAD). The pair is going out near the lows for the day (at 1.24195). The pair has support targets at 1.2396-01 and then the double bottom at 1.23547.

Below is the snapshot of the winners and loser for the day. The JPY is the strongest. The AUD is the weakest. The USD - which was higher against all the major currencies with the exception of the JPY at the start of the day - is ending the day lower vs. all the major pairs with the exception of the AUD.