Forex news for US trading on November 23, 2015

- US major stock indices squeak out small gains

- Fed to overhaul standards for large bank examiners

- Hostage situation in France near Belgium - RTRS

- Fed discount rate minutes: 9 banks voted for hike

- Euro downside limited from here - Credit Agricole

- Russian warship told to destroy any threats seen to Russian planes

- US stocks rebound. US bonds near unchanged.

- US sells 5 year notes at 1.670% vs 1.663% WI

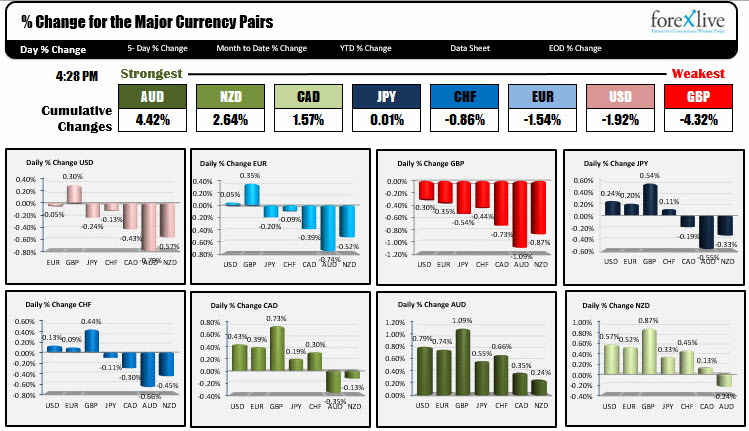

- Commodity currencies lead the way

- Turkey PM: Downing of Russian jet was full in line with Turkey's rules of engagement

- Obama says there's issues with Russian operations near Turkish border

- Citi says to cut US dollar longs

- Russia could play a more responsive role in Syria says Obama

- There's no official information on fate of Russian pilots - Kremlin

- Do you ever get the feeling that a market just doesn't like you?

- Russia working on 'package of measures' to respond to incidents

- Stock market decline extends as geopolitical fear mounts

- US Nov consumer confidence 90.4 vs 99.5 expected

- Richmond Fed -3 vs +1 prior

- December 3rd just got even bigger

- Putin warns of 'very serious consequences' for Turkey

- Watch risk trades as Russian pilot killing hits Reuters

- Belgian business confidence -3.9 vs -4.3 expected

- September 2015 US Case/Shiller 20 city house price index 0.6% vs 0.3% exp m/m

- ECB's Mersch says he's ready for good discussions at Dec meeting

- Philly Fed Nov non-manufacturing survey 26.3 vs 17.5 prior

- US Q2 GDP (second reading) 2.1% vs 2.1% expected

US GDP came in at 2.1% which was as expected. The orginal estimate was 1.5%. Consumption was lower than expectations at 3.0% vs. 3.2%. Inventories accumulated at a higher pace than previously estimated. Higher inventories increase GDP but it can be at the expense of 4Q growth as businesses slow production to help absorb the bloated inventory levels.

Philly Fed Non Mfg index increased to 26.3 from 17.5. Case Schiller home prices increased by 0.6% (vs +0.3%), Richmond Fed and consumer confidence were lower than expectations..

Geopolitically, Turkey shot down a Russian fighter jet, but after some initial saber rattling from Russia, the market concluded, things could have been worse. As a result, stocks which were down early on, reversed. There were reports of a hostage situation near the border of France and Belgium. It ended up being just an ordinary "hostage situation" and not a "terrorist situation". Phew.

The dollar today was more pressured vs. the commodity currencies. The AUD, NZD and CAD were all higher on the day. Higher oil prices (+2.13%) and commodities helped all move higher. Also, a recovering stock market did not hurt risk focused trades. The AUDUSD is closing at the highest level in November and looks like it wants to extend (to the upside) what has been the most narrow month trading range since August 2014.

The EURUSD and GBPUSD were tied to the EURGBP and visa versa. EURGBP surged higher and that helped to keep the EURUSD supported, while the GBPUSD tumbled to new lows going back to November 9.

For the GBPUSD keep an eye on the 1.5086-1.5106 as topside resistance. In the NY afternoon, the GBPUSD moved up to a high of 1.5193 before trailing off into the close. The bears remain in control.

For the EURUSD watch the 100 hour MA in the new trading day at the 1.0664 level. There were two test above and two tests that quickly failed. Admittedly, the price did not go down much either. So there is a battle between the buyers and the sellers. Watch the 1.6030 level. A move below could solicit more selling in the new trading day.

The USDJPY fell below the 100 bar MA on the 4-hour chart for the 1st time since October 22nd. The MA comes in at 122.60 currently. Stay below and then move below 122.20 and the 100 day MA at the 121.755 becomes a focus for the correction lower.

US Durable Goods, personal income and spending, initial unemployment claims (a day early because of the Thanksgiving day holiday), Flash PMI services, New home sales and Univ of Michigan all get released during the US session tomorrow. After the market digest the data, look for activity to slow as traders in NY look for an early exit for the Thanksgiving Day holiday on Thursday.