Forex news for NY trading on January 25, 2018.

- US stocks end the session mixed. Dow/S&P records.

- Interesting take on US dollar weakness

- PIMCO sees the US dollar headed sideways this year

- Gold reverses on the dollars run higher

- US dollar rockets higher as Trump endorses strong dollar

- Bank of England says technology problems causing transaction issues

- Trump: Dollar is going to get strong and stronger

- EURUSD heads down on comments from Trump that he ultimately wants stronger dollar

- Some ECB officials said to prefer June for next policy shift

- Trump and May want UK-US trade deal as soon as possible

- ECB sources: Rate setters split about next move - report

- BAML says EUR/USD will hit 1.10 by April 1. Here's why

- Trump: I think we have a good chance of renegotiating NAFTA, but we'll see what happens

- US 7-year Treasury note sale 2.565% vs 2.580% WI bid

- Canada chief NAFTA negotiator: Mood at talks "is still reasonably constructive"

- Atlanta Fed GDPNow comes in unchanged at 3.4% for 4Q

- Bitcoin volatility down. Consolidates around MAs

- Nouriel Roubini says tether is a scam and without it Bitcoin would fall 80%

- European major indices ending the day with mixed results

- KC Fed manufacturing index +16 vs +14 expected

- NAFTA negotiators have not moved 'an inch' so far - report

- US December new home sales 625K vs 675K expected

- SNB's Jordan ready to intervene in FX markets if necessary

- Draghi says explicit targeting of exchange rates not what has been agreed for some time in G20

- Bank of Canada's Poloz: We are totally data dependent

- Draghi says ECB have concerns over possible change in US policy

- Draghi repeats that ECB does not target exchange rates

- More from Draghi: Discussion on tapering guidance hasn't really started yet

- EUR pairs enjoying the Draghi & Co show so far

The snapshot of other financial markets is showing:

- Spot gold is down -$11 or -0.8% at $1347.54. The price of gold reversed on the dollars reversal higher

- WTI crude oil futures are trading down $.37 or -0.56% at $65.24. Like gold, the price of oil reversed on the turnaround in the USD

- The S&P and Dow both closed at record levels. The S&P eked out a small 0.06% gain. The Dow was up by 0.54%. The NASDAQ lagged with a small -0.05% fall.

- Bitcoin on Bitstamp is trading down $30 at $11,203. That is just above the 100 day MA at $11,111.

- US yields saw the longer end move lower. 2 year 2.084%, up 0.8 basis points. Five-year 2.4217%, down -1.2 basis points. 10 year 2.6207%, -2.6 basis points. 30 year 2.8857%, -4.3 basis points

The markets had a wild ride today with two events providing the catalyst.

In the morning, the ECB kept rates unchanged but the market did not jump on anything Draghi said as being too bearish for the currency. He did say he had "additional concern over unwanted tightening of US monetary policy" and "based on today's data there is little chance at all that the ECB interest rates will be raise this year". He also said that FX rates were a risk to the recovery.

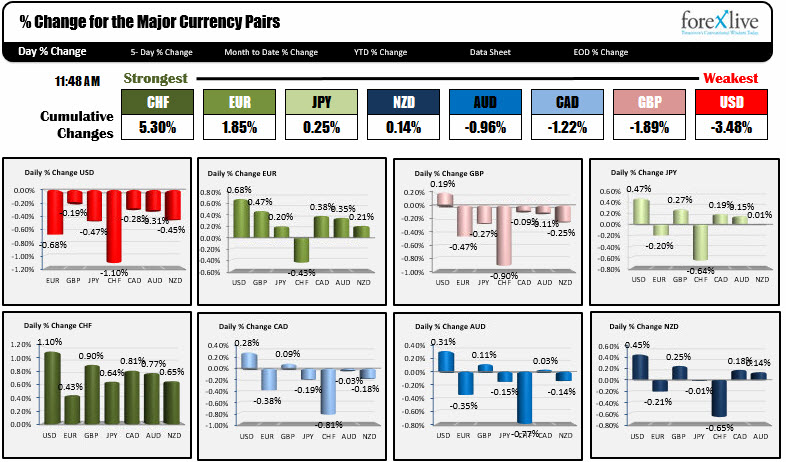

The market did not bite, and the EURUSD led the way to the upside, and that - once again - dragged the US dollar lower. At the US midday, the dollar was the weakest of the major pairs while the CHF and the EUR were the strongest.

PS for the CHF, SNBs Jordan commented that they were "ready to intervene in the FX market", which was met with more CHF buying. I guess it was that kind of day.

The run lower in the dollar took the major currency pairs through key levels.

- The EURUSD moved above a trend line on the daily chart at 1.2463 and moved to a high of 1.2537.

- The USDJPY fell below a support floor area at 108.60-819 to a low of 108.49.

- The GBPUSD moved above a trend line on its daily chart at 1.4273 on its way to a high of 1.4344.

- The USDCHF fell below a floor at 0.9428-43 to a low of 0.9288.

Then President Trump, over in Davos Switzerland, in an exclusive interview on CNBC, back tracked some of the bearish dollar comments from Treasury Secretary Mnuchin (does that guy know what he is talking about?), by saying the dollar was to go higher on the back of the strong US economy.

Fast break the other way.

- The EURUSD moved back below the 1.2463 level on its way to new day lows at 1.2363. It is trading at 1.2393 near the close.

- The USDJPY rose back above the 108.60-819 level to a high of 109.69. It is trading at 109.40 near the close

- The GBPUSD fell back below the trend line at 1.4273 on its way to a new low at 1.4081. It is trading at 1.4130.

- The USDCHF moved back to a high of 0.9448.

Volatile times.

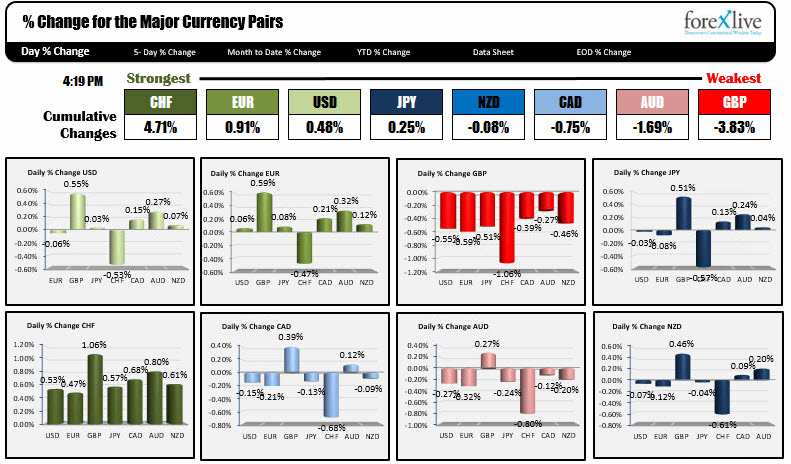

The end of day snapshot shows a different picture for the fortunes of the dollar. Instead of being lower and down against all the major currency pairs, it ended the day up or near unchanged vs. all the major pairs.

The big question for the final day of the week is "Will the real USD please stand up?". Will the "Bearish Dollar" stand up and those key technical breaks seen in the US morning be rebroken? Or will there be a new "Bullish Dollar" take charge and push the greenback higher?

Tomorrow...Pres Trump gives the closing speech at Davos and the US will release the 4Q GDP where growth is expected to come in at 3%. Each should provide some more fireworks for traders.