FX news for US trading on Nov 27, 2015:

- King dollar reigned supreme again this week

- BOE's Carney: Global economic environment "pretty unforgiving"

- UK economy has lost momentum - RBS

- There is a 100% chance this one piece of economic data will tell you nothing today

- October 2015 Canadian PPI -0.5% vs -0.1% exp m/m

- Gold plunges to lowest since Jan 2010 as stops hit

- Russia says it's allocated additional military security for its fighter jets

- Turkey's Erdogan tells Russia not to play with fire

- A look into the future by way of German consumer confidence

- German 5 year yields dip below ECB's -0.20% threshold

- Gold down $15 to $1057, a six year low

- WTI crude down $1.33 to $41.71

- US 10-year yields down 1.4 bps to 2.20%

- S&P 500 up 1 point to 2090 in abbreviated session

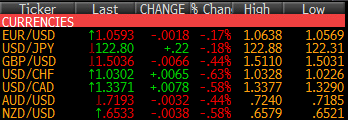

- USD leads on the day, CHF lags

It was a much brisker day than expected. A few events in Asia and Europe set the stage for volatility, especially the 5.5% plunge in Chinese stocks.

The euro challenged the 7-week low set earlier this week. It has been higher at the start of European trading but it was sold heavily down to 1.0568 from 1.0635. That was just a handful of pips ahead of Wednesday's low but the support held and it chopped up to 1.0586 at the close.

The broader story was a dollar slump in Asia and a reversal for the remainder of the day. USD/JPY fell to 122.30 but stormed back a few hours later and continued to 122.60 by the start of US trading and then all the way to 122.88 late. In the grand scheme of things, that's a modest move but it's a good run in thin trading and an impressive sign for USD given the upcoming risks and crowded position.

Cable didn't like the GDP report and fell to 1.5030 from 1.5090. It bounced to 1.5060 a few times in US and European trading but finished very close to the lows. The November low of 1.5026 is a big support level and the main one to watch when markets reopen.

USD/CAD finally got a lift from oil as it made a steady climb to 1.3370 from 1.3290 starting in Asia and continuing until London went home. The OPEC meeting is next week.

The Australian dollar is having a hard time of it after Thursday's capex data and the latest rout in China. It was down 32 pips today but all things considered it was a decent week for AUD despite terrible news on the commodity/domestic/China fronts. Last at 0.7191.

In CHF there was talk of intervention ahead of the ECB as USD/CHF rose to multiyear highs. It was all speculation with no hard (or even soft) reports to back it up.

Gold hit a five year low in a quick move lower as stops were hit below $1064. The losses extended as low as $1052 and then gold bounced $4 to finish. The chart isn't a pretty picture but there is some support nearby.

Have a great weekend and if you're looking for something for Christmas, look no further.