Forex news for NY trading on May 30 2019

- The good and bad (technically) of Bitcoin

- Pence: US can 'more than double' tariffs against China if needed

- Pence: Trump will likely meet with Xi at the G20

- Crude oil futures settle at $56.59

- BOC's Wilkins: We're trying to square solid growth in jobs/wages with weak consumer spending

- May seasonal trading scorecard: Score a hat-trick

- Fed's Quarles: Financial stability must be a consideration in setting mon pol

- Clarida Q&A: Downside risk could call for more accommodative policy

- Fed's Clarida: US economy is in a good place

- European shares end the day with mostly modest gains

- Italy's Tria: Strong slowdown but to debt increase in 2018

- US crude oil inventories -282K vs -1360K estimate

- US April pending home sales -1.5% vs +0.5% expected

- US Iran envoy says will respond with force if Iran attacks

- Trump says US is doing well with China, promises 'dramatic statement' on border

- US April prelim wholesale inventories +0.7% vs +0.1% expected

- US advance goods trade balance for April -72.1B versus -72.7B estimate

- Canada Q1 current account -$17.35B vs -$18.1B expected

- US initial jobless claims 215K versus 214K estimate

- US Q1 GDP (second reading) +3.1% vs +3.0% expected

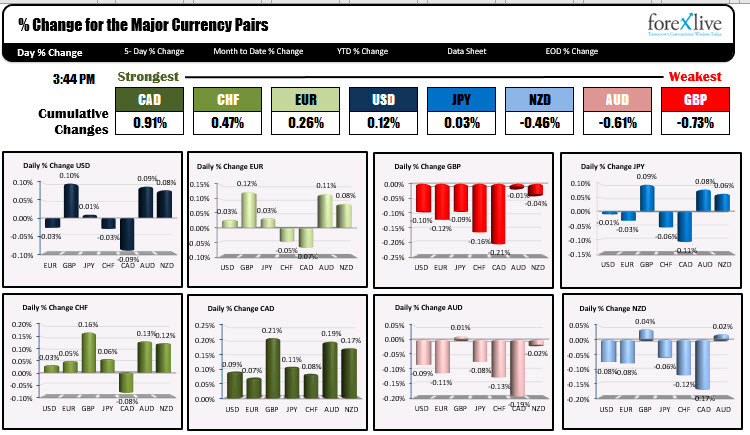

- The CAD is the strongest. The JPY is the weakest as NA traders enter for the day

A snapshot of the other markets as the NY session works toward the close is showing:

- Spot gold, up $8.30 or 0.65% at $1288.07

- WTI crude oil futures fell sharply. It is trading down $2.27 or -3.86% at $56.54

- The price of bitcoin on Coinbase is trading down $50 at $8596. The high price today reached $9090, the highest level since March 2019. For a technical look at the good and bad for bitcoin, CLICK HERE.

In the US stock market today, price action was higher earlier. The indices then gave up all the gains and moved into the red, before rallying into the close and ending the sesssion higher. The Nasdaq led the way with a gain of 0.27%. The S&P rose 0.21% and the Dow rose 0.17%.

European shares also closed mostly higher with the exception of the Italian FTSE MIB. Below are the highs and lows and percentage changes of the major North American and European stock indices.

US yields tried to move higher, but the stock indices giving up gains, tame inflation from the GDP numbers this morning, and some dovish comments from Fed's Clarida, took yields back lower yet again. The 10 year moved to a low of 2.2098%. That is near the low from yesterday, and which was the lowest level since September 2017.

In Europe, 10 year benchmark yields ended the session with modest gains:

The dollar was a little higher in early trading in the NY session, but there were a couple catalysts that spoiled the "Dollar is King" theme.

- The core PCE data for the 1Q GDP data came in at 1.0% vs 1.3% estimate. That is 1/2 of the Fed's target. The April reading for Core PCE will be released tomorrow. Given the week reading for the Q1, the start of April number will be key for the markets inflation expectations. Fed officials have been touting the idea that inflation is transitory. Is it? See Adam's post here.

- Crude oil inventories came in with a smaller than expected drawdown (-282K vs -1360est and the private API number of -5265k (see post here)). Oil started to move lower on thoughts of slower global growth.

- Stocks started to give up gains. That in turn sent yields lower

- Finally, Fed's Clarida was a bit more dovish saying downside risk could call for more accomodative policy.

For the USDJPY the pair, moved higher early in the day in response to stock gains and steady rates. The price moved above the 200 hour MA for the first times since May 23rd, but stalled near the 50% retracement at 109.91, reversed back below the 200 hour MA at 109.76 and marched lower into the NY afternoon until reaching the 100 hour MA at 109.476. That stalled the pair and it is trading at 109.59 near the close.

The EURUSD - like the USDJPY - first moved lower (dollar higher) and reached a low of 1.1115. That was within 9 pips of the 2019 low of 1.11064. Failure to extend to the low and a reversal of the dollar buying, took the pair back above the low from yesterday (and the Asian session low today) at 1.11237 and up toward a swing area at 1.11414-435. In the new day, a move above that area should solicit more buying, while a move back below the 1.11237, should see traders probe the 2019 low at 1.11064 at some point tomorrow.

The GBPUSD fell to the lowest level since the January 3rd flash crash. However, the pair stalled at the January 2nd low (which would be the low sans the flash crash) at 1.2580. The hold send the price modestly higher with an afternoon high at 1.2619.

Below is a snapshot of % changes of the major currencies vs each other. The pairs are ending the day relatively scrunched together with the CAD the strongest and the GBP the weakest.

The chart of the low to high extremes and the pip changes for the major pairs highlights the up and down price action. The largest pip change for the major pairs vs the USD was 12 pips.

Wishing you all a great evening or new trading day. For our friends in Asia, have a great weekend and thank you for your support.