Forex news for North American trading on October 9, 2020.

- Stocks close at the highest level since September 2. Dow closes positive for the year

- Trump to host in-person event Saturday at the White House

- CFTC commitments of traders: EUR longs lowest since end of July

- Crude oil futures settle at $40.63

- Pres. Trump now says that he wants more aid than either party is offering

- France coronavirus cases rises to a record 20,339

- Silver rises by 5% on the day

- US CDC Covid cases rise to 54,887 vs 53,051 yesterday

- Baker Hughes oil rig counts rises to 193 from 189 last week

- Norwegian oil strike called off

- Fox: McConnell does not have votes for $1.8 trillion package

- McConnell: Doesn't know if there will be a deal or not

- Pres. Trump: We have a cure, more than just a therapeutic

- NEC Director: Pres. Trump want to do a deal on stimulus. Pres. Trump...."Go Big!"

- McConnell: You're never going to get a deal out of Pelosi that the GOP likes

- UK Covid cases rise by 13,864 compared to 17,540 yesterday

- US wholesale inventories for August final come in at 0.4% vs. 0.5% estimate

- Senate Maj Leader McConnell: Can't see that a new stimulus deal before election

- Fed's Evans: If recovery is slower, sees more asset purchases

- Richard Fed Pres. Barkin: Fed continues to do what it can do to provide support

- Canada net change in employment for September 378.2K vs. 150K estimate

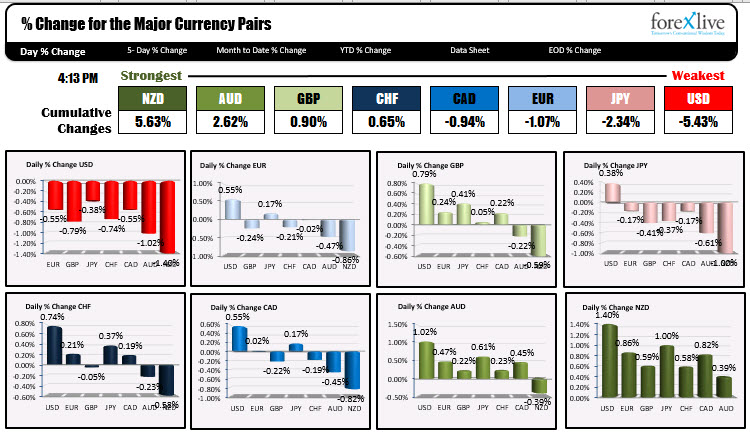

- The NZD is the strongest and the USD is the weakest as NA traders enter for the day

Oh Canada! The US employment data was released last Friday, so Canada had all the attention to itself today when they released their jobs report for the month of September. The numbers did not disappoint. The net change in employment rose by 378.2K vs. expectations of 150K. Most of the job gains were in full-time employment with a gain of 334K (vs. 205.8 K last month). Part-time jobs rose by 44.2K. The unemployment rate fell sharply to 9.0% from 10.2% last month and much lower than the 9.8% expectations. Hourly wages increase by 5.4%. The participation rate rose to 65% from 64.6% last month. All was good news.

The number sent the CAD higher/the USDCAD lower. Moreover, the move helped to kick start a dollar lower trend that continued in the other currencies in trading today.

Looking at the strongest and weakest currency rankings (see chart above), the USD is ending the day as the weakest currency on the day by over doubled the margin from the next weakest. The NZD was the strongest.

The dollar fell partly on the back of "risk on " sentiment. US stocks market rose smartly once again with the major indices close at the highest level since September 2.. That helped to send flows into currencies like the NZD and AUD.

The dollar may also be lower because Washington lawmakers (and the President) seem to be playing a game on the stimulus where nothing gets done. This week the President went from "I am calling off all stimulus negotiations until after the election" on Tuesday, to "I want to provide more aid than either party is offering". Meanwhile, Senator McConnel says the GOP does not want to go over $1.8T. The Dems are at $2.2T and both have other requirements like aid to state and local government for the Dems, and "no liability" for the GOP. PS later toward the close the White House spokesperson said that the White House was now looking for $1.8 trillion max deal (and not better than all of the other deals) .

Do you ever get the feeling where there is so much sarcasm going around that it's hard to tell the truth from reality?

I get the feeling neither party wants a deal, but that's not stopping them spewing off a bunch of lies in the process.

Who knows maybe there will be a surprise deal over the weekend, but if the pundits are right, the Dems have one agenda, the GOP another, and now the President a third. At the end of the day, the GOP - who controls the senate - will have to approve and vote on a deal at least until January. The election results in 3+ weeks will decide who controls Washington at that point. In the meantime, I can't help but think the president will be doing all he can to prop up the stock market, and the Dems will do all they can to shift blame on the President.

Some technical thoughts on the major currencies:

- EURUSD: The EURUSD surged above a downward sloping trendline on the hourly chart at around 1.1797 and then the high price for the week at 1.18075 and the 50% midpoint of the move down from the September 1 high. That level comes in at 1.1811. Going into the new week staying above the midpoint would keep the buyers firmly in control. The next upside target would come in at 1.1858. That is the 61.8% retracement of the same move down.

- GBPUSD: The GBPUSD traded to the highest level since September 8 as the clock ticks toward the October 15 "drop dead" date imposed by PM Johnson with issues (like fishing) still to be resolved. The price action today moved above a swing area between 1.2999 and 1.3006 that has capped the pair going back to September 11. That area is now support and a risk defining levels for longs. Stay above, and the buyers are in control. Move below and the sellers are back in the game. The pair is up testing a topside trend line on the hourly chart (connecting highs from October 1 and October 6) at 1.3040 (and moving higher). In the new week, that level will be the closest barometer for bulls and bears. More upside momentum will have traders eyeing the 50% midpoint of the move down from the September 1 high at 1.30777. A move above that level opens the door for further upside potential.

- USDJPY: The USDJPY did not find sellers of the JPY (buyers of the USDJPY) on risk on sentiment, but instead saw the pair move lower with the overall dollar selling. The pair cracked below its 100 hour moving average at 105.822 in the early New York sessionand quickly scooted down to test the 200 hour moving average at 105.672. After consolidating above and below that moving average level for a few hours, sellers reentered in the New York afternoon pushing the pair down to session lows at 105.57.Technically, the 200 hour moving average (at 105.672) will be resistance in the new trading week. A move above that level would have traders looking back toward the 100 hour moving average at 105.822. On the downside the next key target comes in at 105.519. That is the 50% midpoint of the range for the month of October. Get below that level should open up the door for further downside.

- NZDUSD: The NZD was the strongest currency, and the NZDUSD was the biggest mover with a gain of 1.4% on the day. That move got a shove higher in the NY session when the pair moved above near converged 100 and 200 hour MAs at 0.6610 area. The subsequent run to the upside was able to extend above the 50% retracement of the range since September 18. That level came in at 0.66539. Swing highs from October 1, October 2, October 5 and October 6 all came between 0.6653 and 0.6657. That ceilingwas also broken. In the new trading week staying above 0.6653 will be more bullish. Move below and there could be some further corrective downside momentum. On more upside, swing levels from mid-September come in between 0.6674 and 0.6683. The 61.8% retracement of the move down from the September 18 high comes in at 0.66877. Get above that level and further upside momentum can be expected.

- USDCAD: The USDCAD peaked on Wednesday and trended lower since that high at 1.33397. The low price of the last hour of trading at 1.3116. Technically, the pair fell below its 61.8% retracement of the range since September 1. That level comes in at 1.31556. Stay below that level in the new week of trading and the sellers remain in control. On the downside the end of day selling took the price below swing areas from mid-September between 1.3118 and 1.3126. That will be close resistance in the new trading week. Staying below 1 of traders looking toward the September lows which extend all the way down to 1.2993.