The latest in our series of previews looks ahead at the UK trade balance for August due tomorrow (Friday) at 08.30 GMT with stats compiled by the independent, albeit questioned by Carney for its accuracy, Office for National Statistics

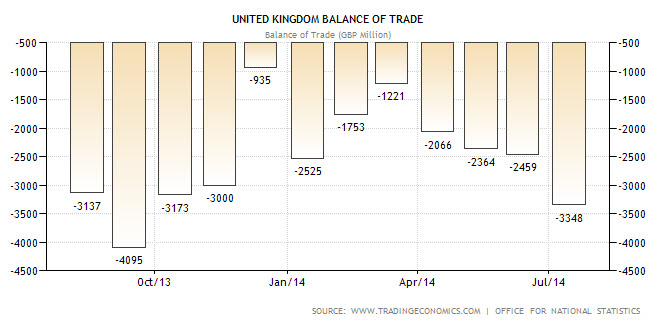

The overall UK trade deficit for July, which we assessed here, widened to GBP 3.3bln in July vs GBP 2.5 bln in June, the widest trade gap in over two years. Imports of goods recorded the largest monthly increase in nearly two years driven by purchases of fuels and chemicals after a large increase in imports swamped the effects of a modest increase in exports.

UK net trade deficit mm

Total exports of goods and services amounted to GBP 40.83bln in July with imports at GBP 44.18bln. There was a deficit of GBP 10.2bln on goods partly countered by an estimated surplus of GBP 6.8bln for services.Medicinal and pharmaceutical trade remains one of the UK’s most significant industries, growing by more than 100% over the past ten years.

The data showed that a mix of weak Eurozone activity and strong domestic demand are hampering Britain’s attempts to find an economic balance to sustain any recovery, a problem which both fin min Osborne and BOE gov Carney are only too aware of. And I can’t see any good reason for the data to please either of those boys tomorrow unless the awful German trade balance data published today (Thurs) which showed a large fall in exports in the same period is reflected in our import figure which in July rose +3.9% vs exports +2.1%

August saw a fall in GBPUSD from 1.6862 to 1.6540 but EURGBP was pinned between 0.7900-0.8000 for the most part, so we won’t be seeing any real benefit from currency moves given that we are net importers .

The Visible Trade (goods) deficit for July came in at a whopping GBP -10.186bln, the biggest gap since April 2012. The widening is mainly attributed to manufactured goods which accounts for roughly two thirds of the total deficit.

UK Visible Trade Balance mm

So what are markets looking for this time ? Well here’s the forecasts:

Forecast Previous

UK trade balance Aug 2014 forecasts

Often this data can have muted impact on pound pairs. The market tends to accept the fact that we run a deficit but the attention is always in the detail so ignore at your peril, but don’t expect it to immediately change prevailing trend.

Let’s see where we are closer to the time