As posted earlier, the GBPUSD was likely to have reached a peak in the London morning session. The correction lower did indeed find support buyers against the 100 hour MA (blue line – SEE POST HERE). The pair is finding some additional momentum as confidence increases. Risk now is firmly to the upside.

Technical Analysis: GBPUSD bounces off the 100 hour MA

Seeing a report that Pfizer may be weighing another bid for AstraZeneca. This is in the face of the restrictions on inversions but that is for another day I guess.

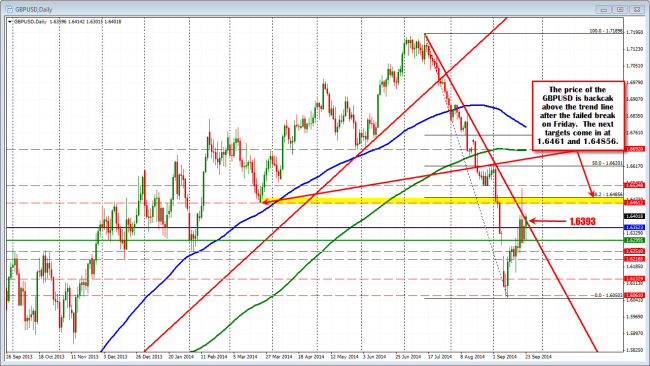

The pair has the high for the day and then the underside of the broken trend line as targets now (at 1.6433). Above that, the 1.6461 was the low from March 2014 and 1.64856 is the 38.2% of the move down from 2014 high to the low reached this month (see daily chart below).

Technical Analysis: GBPUSD moves back above trend line at 1.6393