Gold posted its largest one-day rise in three years on Friday — gaining nearly $80. This week, gold has moved sideways, which has to be considered a victory for the bulls after such a swift move higher.

Today’s range of $1612/22 is especially tight but could be jarred by the ISM non-manufacturing data at the top of the hour. A soft reading would add fuel to the QE3 debate and boost gold.

Gold may continue to trade sideways until Thursday’s testimony from Bernanke and ECB decision. Technically, the break of $1600/04 points to a test of $1670 but any hint of further QE would spark a rally to $1780 and perhaps higher. I expect ‘buy the dips’ will be a continued theme.

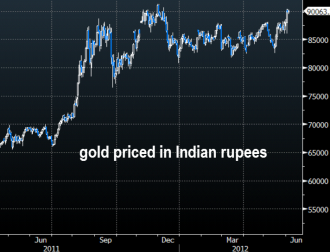

One headwind comes from the slowdown in emerging markets. Reports from India show “very poor” demand and that consumers are “selling aggressively” with prices near all-time highs in INR.