Gold is a tough one to explain at the moment.

On one side the normal safety status may be holding it up, though there’s not really enough real agro in the world right this minute to warrant a big push up. The prospect that rates will continue to stay low will also keep some of the specs on the bid.

On the otherside, Chinese demand was said to have fallen by 52% in Q2 as customers dropped back from buying coins and bars (ingots not liquor) and jewelry. Demand was less across all the major Asian buyers bar (except not ingots or liquor) Taiwan.

Take that all into account and it’s no surprise to see it going sideways

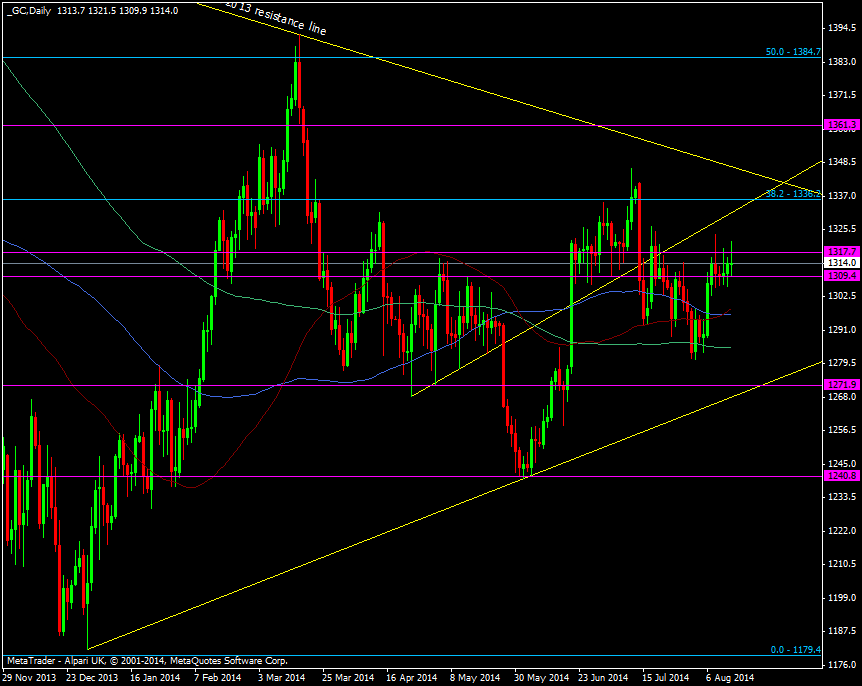

Gold daily chart 14 08 2014

1309 and 1318 have kept us in place the last few days and stringer support and resistance is wider at the 1305-1325 edges. To be honest I’m surprised we’ve not fallen on the demand news as that’s a large drop in demand from the current biggest importers. That suggests that there are decent levels of spec buyer holding gold as before the Russian/Ukraine and Iraq situations kicked off we were trading a more natural commodity market on supply and demand rather than speculative.

It looks like it’s going to be a battle of who folds first and my money is on the spec mob if we get more falling demand worries and if the geo-news wanes. If the Russians do deliver this aid convoy without trouble then that may see some safe haven trades unwind. All in all unless it really kicks off somewhere my instinct says that any sizeable move will be down in the first instance.