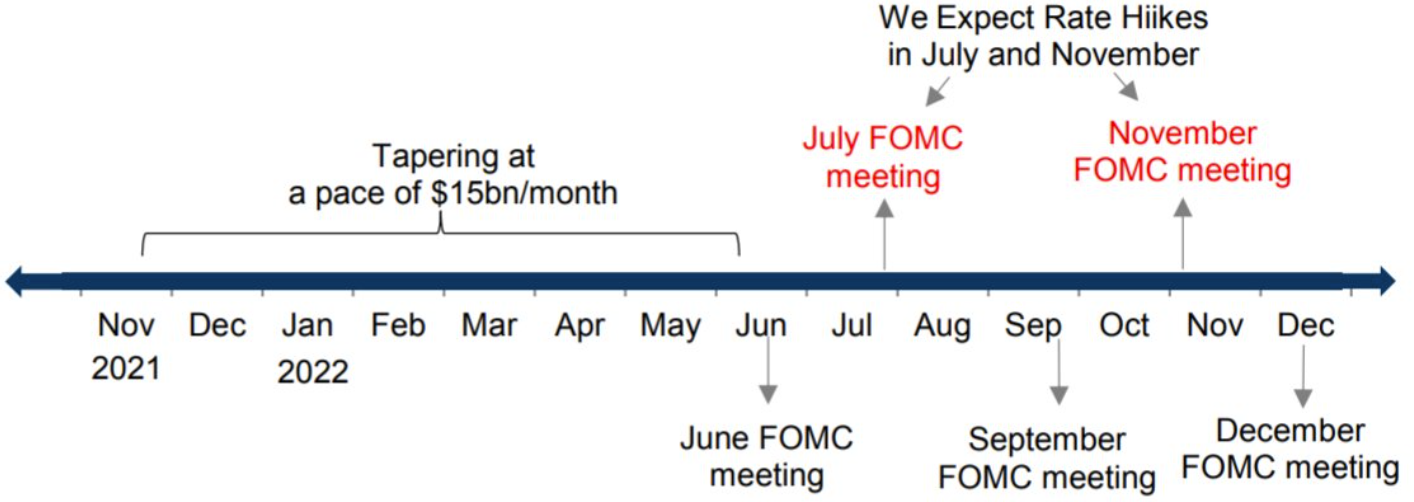

For the Federal Open Market Committee, Goldman Sachs see what they describe as a "seamless" transition from tapering to rate hikes

- They expect the first rate hike 'liftoff' in July 2022

On inflation GS forecast core PCE inflation to rise further in the US winter, but eventually falling to low 2% levels

- "as a transitory inflation boost from durable goods becomes a transitory deflationary drag in late 2022 and 2023"

On economic recovery GS expect the slowing due to the Delta wave has passed, growth is accelerating again, with a ways to go for the service sector. But:

- "declining fiscal support will be a major growth headwind through the end of 2022

- "as near-term boosts from reopening, pent-up savings, and inventory restocking subside, growth should decelerate to potential by late 2022"

On the jobs market, GS are looking for the jobless rate to drop to its 3.5% pre-pandemic low in 2022. GS still see participation is likely to remain below its pre-pandemic trend.

- "strong labor demand and reduced labor supply should keep wage growth just above 4%, stronger than last cycle but compatible with the Fed's inflation goal"

Goldman Sachs graphic on the timeline for tapering and hikes ahead: