Goldman Sachs technical analysis of EUR/USD notes the need to be cautious, saying the EUR/USD may not extend its rise beyond the Fibonacci retracement at 1.2959.

-

The next level higher in EUR/USD is 38.2% of the drop since Jul. 1 st at 1.2959, notes Goldman Sachs.

“Given the impulsive nature of the decline since May, and the likelihood that it’s now in its 4 th wave of a 5- wave sequence off the May high, it doesn’t seem too likely that the market will extend further than that point,” GS argues.

“It should therefore be attractive to consider establishing bearish exposure targeting the ’12 low (the bottom of the wedge) at ~1.20 with a close stop above 38.2% retrace at 1.2959,” GS advises.

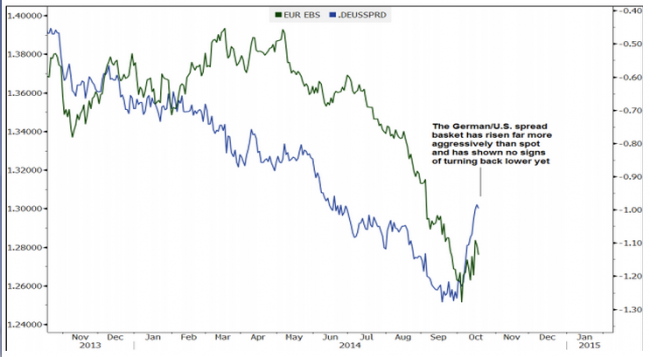

The only concern at this point, according to GS, is the fact that the German/U.S. spread is rising faster than spot.

“This chart shows EURUSD in green and an equally weighted basket of the German/U.S. 2-/5-/10-year yield spread in blue. The basket has in recent weeks rallied much more sharply than spot and at these levels, and is showing very little sign of momentum loss,” GS clarifies.

“Given how well linked these two have been throughout the course of the decline, it’s important to watch how the link evolves over the next week. Any indication of a turn/top should help to signal that EURUSD might be resuming its trend,” GS adds.

–

Via eFX. There is more investment bank analysis from eFX, here.

–

ps. The EUR/USD chart Goldman Sachs is referencing: