Via eFX: Goldman Sachs – What’s Behind AUD Collapse; What’s Next?

After a six-week breather, the AUD started to depreciate again in the middle of last month and since November 14, it has declined by more than 5.2% against the USD, ranking as one of the weakest currencies in the intervening period, notes Goldman Sachs.

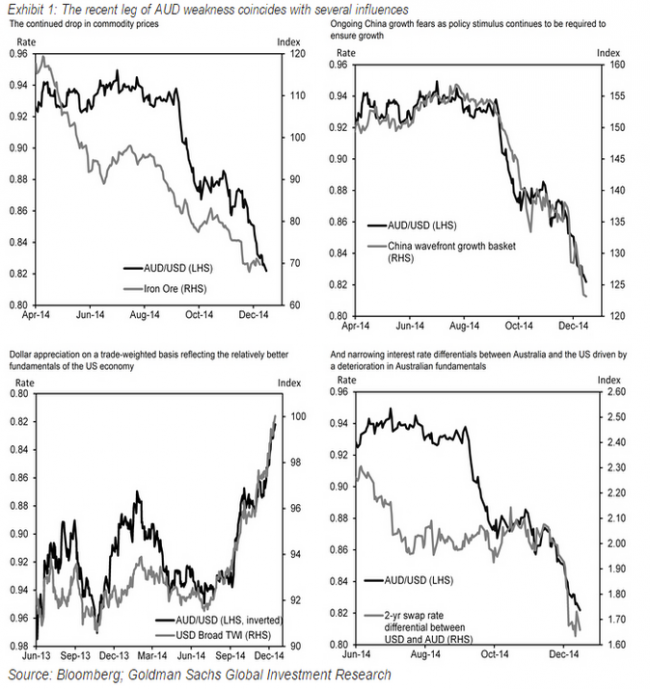

Several factors, according to GS, could have contributed to the move:

1- The continued drop in commodity prices. Iron ore is now at USD68/tn, 50% lower than at the start of the year, with a 12% drop since the beginning of November.

2- Ongoing China growth concerns as the authorities continue to ease policy in order to achieve the 2014 growth target, indicating that underlying growth momentum remains fragile.

3- Dollar appreciation on a trade-weighted basis against the back drop of US economic outperformance and Fed rhetoric which points to rate hikes in mid-2015.

4- Weak Australian data which has prompted the market to discount at least one RBA cut over the next 12 months.

5- And more recently, the rise in risk aversion.

What’s next?: AUD forecasts:

GS now sees AUD/USD at 0.83 in 3 months, 0.81 in 6 month, and 0.79 in 12 months.

Why stop at 0.79? “At 0.79, the big dislocation between the deterioration in Australia’s terms of trade and the AUD will be closed on our estimates and the market already discounts at least one cut from the RBA,” GS argues.

–

More investment bank research and trade recommendations are available at eFX