There is no set time published for the release of Chinese trade balance data, I am expecting it sometime after 0200 GMT.

China August trade data, yuan terms:

- China trade balance: expected CNY 495.5bn, prior was CNY 362.7bn

- Exports y/y: expected 22.5%, prior was 8.1%

- Imports y/y: expected 9.1%, prior was 16.1%

USD terms

- China trade balance: expected $51.0bn, prior was $56.6bn

- Exports: expected 17.1%, prior 19.3%

- Imports: expected 26.8%, prior was 28.1%

2230 GMT Australia - AiG Services PMI for August

Australia Australian Industry Group Performance of Services Index

prior 51.7

2301 GMT UK BRC Sales like-for-like for August

expected 3.2%, prior 4.7%

like-for-like sales data strips out the impact of changes in store size.

2330 GMT Australia weekly consumer confidence

ANZ/Roy Morgan survey

prior 101.8

2330 GMT Japan wages data for July

Labor cash earnings expected 0.8% y/y, prior +0.1% (revised from -0.1%)

Real cash earnings prior -0.4%

2330 GMT Japan Household spending for July

- expected +1.1% m/m, prior -3.2% m/m

expected 2.4% y/y, prior -5.1%

0130 GMT Australia Building Approvals for July

expected -8.6% m/m, prior -6.7%

expected % y/y, prior +48.9% y/y (base effect!)

0430 GMT Reserve Bank of Australia policy announcement and the accompanying statement from Governor Lowe

as I said yesterday, The RBA will be grappling with the question of whether or not to stick to their taper plan in the face of long and ongoing lockdowns of nearly half of the Australian population in its two largest population cities and states. I've posted up a few previews already from about the place:

- RBA monetary policy meeting Tuesday 7 September 2021 - preview

- CBA expect a reversal of the taper decision

- RBA monetary policy meeting next week - sneak peek preview

- Goldman Sachs preview the RBA monetary policy meeting September 7 - Expect QE taper plan to remain

More previews!

- RBA like to delay taper but AUD risks still to the upside - MUFG

- Australian dollar steady ahead of the RBA decision. What to watch out forhe

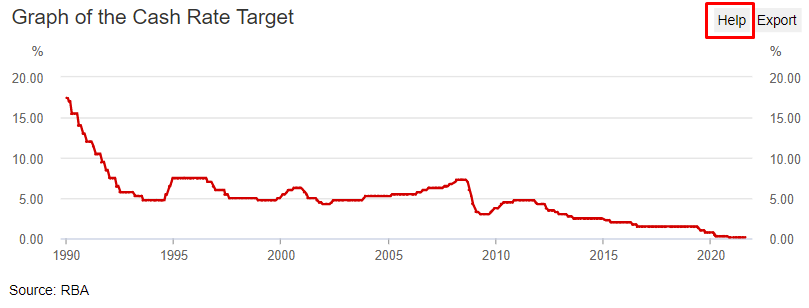

No change in the cash rate will occur today, but I have included this graph as it contains a not-so-hidden cry for help from the RBA. Is there anyone on the ground there in Sydney not locked-down who can check if they are OK?