Welcome to Tuesday 3 November 2020, the Asia session. Which is a bit of a placeholder for the US session and the 2020 election.

We do have the Reserve Bank of Australia to look forward to today, previews:

- RBA monetary policy meeting Tuesday 3 November 2020 - preview

- RBA November monetary policy meeting decision due Tuesday 3rd - preview

- ANZ preview the RBA meeting on November 3 - rate cut and more

- ING make "The case against a rate cut" from the Reserve Bank of Australia

- preview link here.

- And another preview here

Announcement and statement are due at 0330 GMT. There is no press conference to follow, there never is but in case you are wondering.

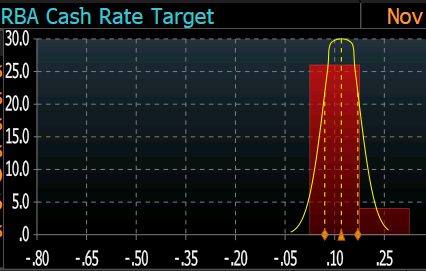

There will be policy changes from the RBA today.They are widely expected, although not all expect rate changes, for example cash rate expectations (via Bloomberg survey):

I am not brave enough to go against the consensus, I'm expecting the full suite of changes as outlined in most of those previews linked above. There is scope for disappointment in the amount of RBA bond-buying in the longer bonds (out to 10 years) announced. The RBA tend to be an overly optimistic bunch and the risk is they announce a buying target seen as 'too little' by the market (a minimum of 150bn is expected, be me anyway), which should prompt some support for the AUD.

With expectations so widely held for so much easing the scope is for AUD support regardless on the announcement.

Does it matter much today? Maybe not, we are all focusing t on the US election, but there is scope for short-term movement regardless. Note it is a partial holiday in Australia today, Melbourne is closed for a horse race. Yes, really. The Melbourne Cup. The 'race that stops a nation' Like there hasn't been enough stopping of nations this year already (thank-you coronavirus). The holiday will mean reduced liquidity for AUD trade today.

Also on the agenda for the session here:

2230 GMT Australia weekly consumer confidence

ANZ/Roy Morgan survey - showing a long run of improvement.

prior 99.7