Commentary from economists at Deutsche Bank warns that higher inflation could lead to a structural recession

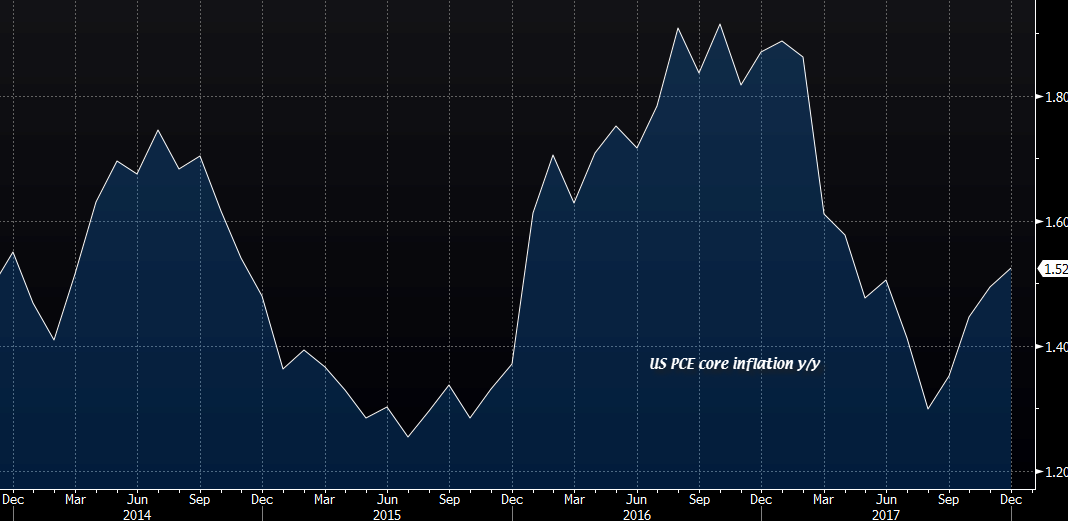

The warning here comes after further signs are starting to show that the US economy is seeing increased inflationary pressures from wage gains, full employment, and Trump's fiscal stimulus.

Deutsche warns that "higher inflation could trigger an across-the-board recession" due to lower investment and higher credit costs in a high-inflation environment.

They also point out that the US economy is currently late in its 10-year economic cycle, which is stirring some concerns of a cyclical recession. But they argue that Trump's fiscal stimulus will effectively prevent such a development, so inflation will be the main factor to watch in case of a downturn in the US economy.

The note also argued that the recent rise in US 2-year Treasury yields means that near-term borrowing costs are increasing rapidly, which in turn could hinder domestic investment and slash points off the economy's growth.

This is another take on the inflation story, which is going to be one of the more dominant market themes for the year. Last week, we had JP Morgan arguing that rising inflation will actually be good for stocks and also BofA arguing that a boost in inflation will spur a rise in the US dollar.