That closes off the year for the US jobs market so what was the verdict?

A very nice beat of expectations to finish 2015 with and the data shows that the Fed are largely justified in pulling the trigger on hikes

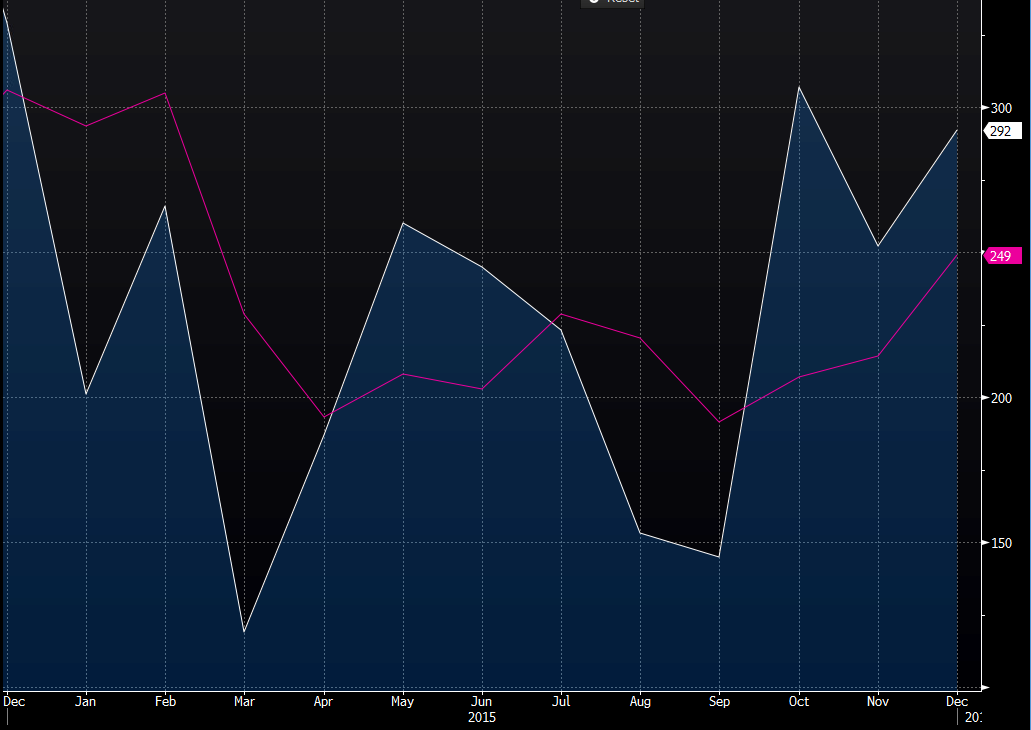

The NFP's end at an average of 249k and bar a weather induced drop early in the year, we didn't come close to posting a negative number. That last happened in 2010 and we're still in the longest run of positive prints in the entire history of the report

NFP 2015

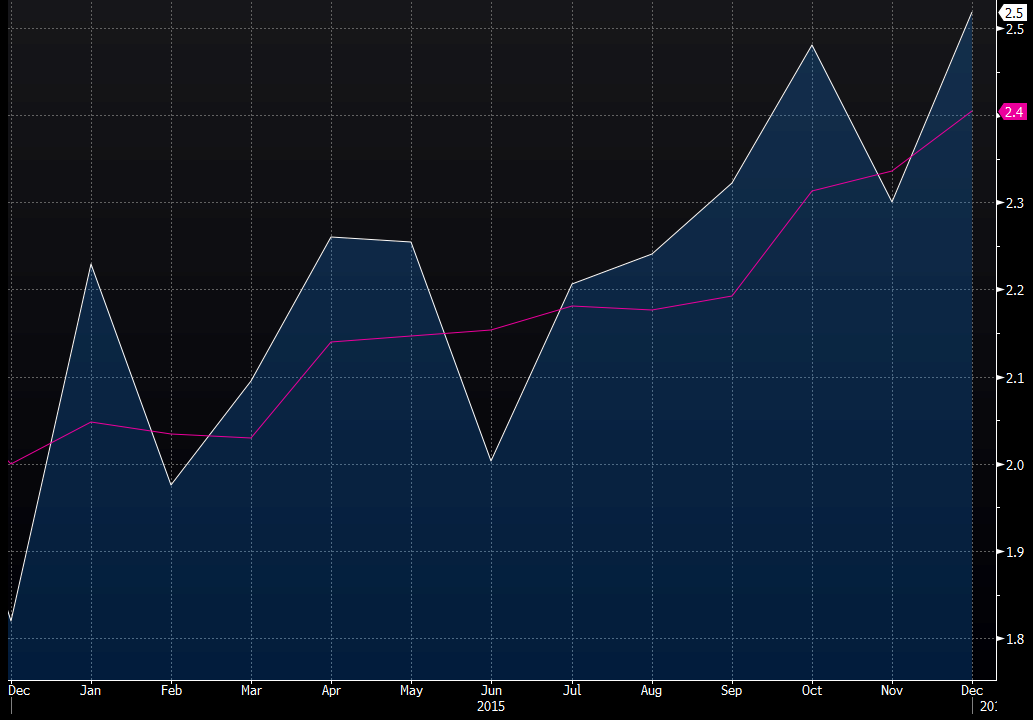

Despite the Oct/Nov drop, wages finished on a high too. While the month on month growth isn't breaking any records the trend is up in earnings growth and the more that continues the more confidence will grow

Average weekly earnings y/y

Unemployment fell to what most would call the full employment level at 5.0%. It started the year at 5.6%.The participation rate almost finished unchanged dropping from 62.7% and hitting a low of 62.4% before the finish at 62.6% This will be another key number to watch as the year rolls on for signs of further confidence returning as more people enter the market

As I mentioned in my NFP preview earlier today, the landscape has changed for how we trade this. There's probably not a lot of room left to see the unemployment rate fall but that will be masked by what happens with participation. The more people that become actively looking for work will add to unemployment. That could see us getting more numbers like today with strong headlines and unchanged unemployment or wages. It all depends on how firms decide to hire and the type of people that enter the market

We can see from the price action what these numbers really mean. If this was a year, 6 months ago we'd be shooting higher in the dollar and sustaining it. Now we've only seen a 30 odd pip jump in USDJPY on the release and that's already been reversed into a near 90 pip loss

No patterns last forever. The big Fed easing to tightening trade is over. We need to change how we view data going forward and what it means for our trading