A trade truce between US and China will be good for risk assets but does that mean the Fed will shelve its rate cut plans?

Although risk assets will steal the focus in the aftermath of the Trump-Xi meeting tomorrow, the dollar and the Fed are likely to be the more talked about topics in the coming weeks with the next FOMC meeting scheduled for 31 July.

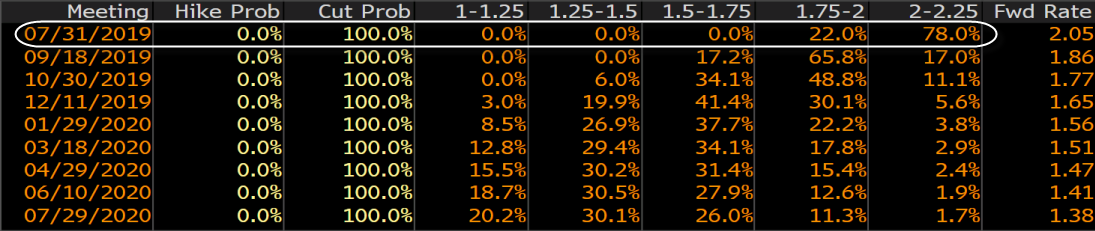

A 25 bps rate cut is all but a given at this point but markets are still seeing a 22% probability that the Fed may cut rates by 50 bps, according to Fed fund futures.

But if US and China are able to achieve a trade truce this weekend, which I reckon they will find some form of agreement to resume talks at the very least, it puts the Fed in an interesting spot ahead of their July meeting.

Final Q1 GDP data yesterday gave little concerns for the Fed to be immediately cutting rates and the revised uptick in PCE is also a welcome sign on the inflation front. And if trade talks find some limited progress in the near-term, it'll be very interesting to see how they would phrase their decision in cutting rates in July.

There's no doubt that if a trade truce is reached, the Fed will want to chalk down the move as an "insurance cut" but it's something that will be difficult for them to communicate in the statement an forward guidance.

As for future rate moves, the Fed has always been about taking a more wait-and-see approach and this time will be no different. They will surely cut rates by 25 bps next month but the timing of their next move - if it does come - will be less certain.

That will hinge a lot on economic data and how the US-China trade rhetoric develops in the coming months. But I reckon a trade truce between the two countries will certainly push back quite a bit of the rate cut expectations over the coming months. And that in turn will give the dollar a bit of a relief after last week's dovish message by the Fed.