IEA with its latest commentary on the oil market

- Implied stock buildup of 12 mil bpd in 1H threatens to overwhelm logistics

- Forecasts a drop in global oil demand by a record 9.3 mil bpd

- Output deal by OPEC+ and other countries will not immediately rebalance the market

- Oil production cuts will lower the peak supply

- Says that still awaiting details on stock purchases, which could withdraw about 2 mil bpd from the market

IEA says that the output deal agreed helps to "absorb the worst of this crisis" but reaffirms that it isn't going to be enough despite last week's achievement being a "solid start".

The market came to terms with that very quickly and oil is in danger of a major break to the downside today, falling by 3% in a drop under $20 currently.

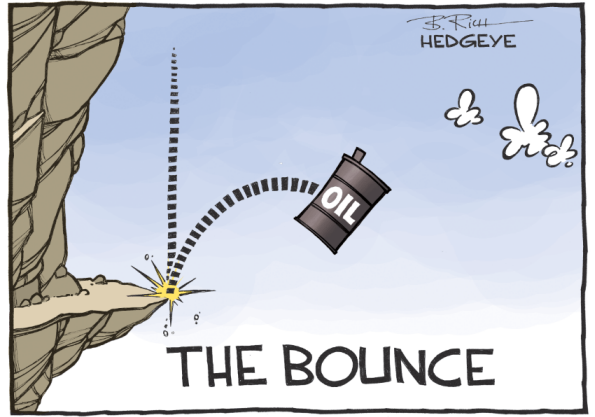

This has indeed been a very apt depiction of price action over the last two weeks: