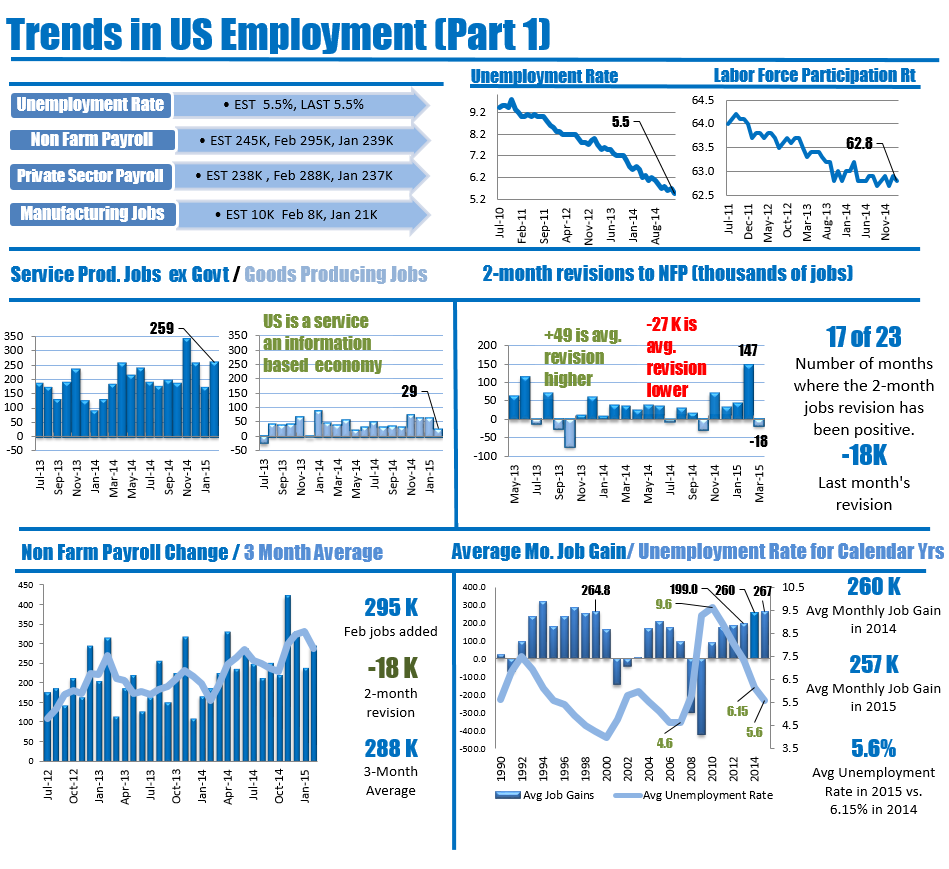

Trends of the major jobs components

The US employment report will be released at 8:30 AM ET on Friday. The estimate according to Bloomberg is for a gain of 245K in nonfarm payroll jobs. My guess - given the weakish ADP report (188.7 K) - is that the market is expecting something smaller than that figure (say to 225K).

Some of the other estimates:

- The unemployment rate is expected to remain steady at 5.5%.

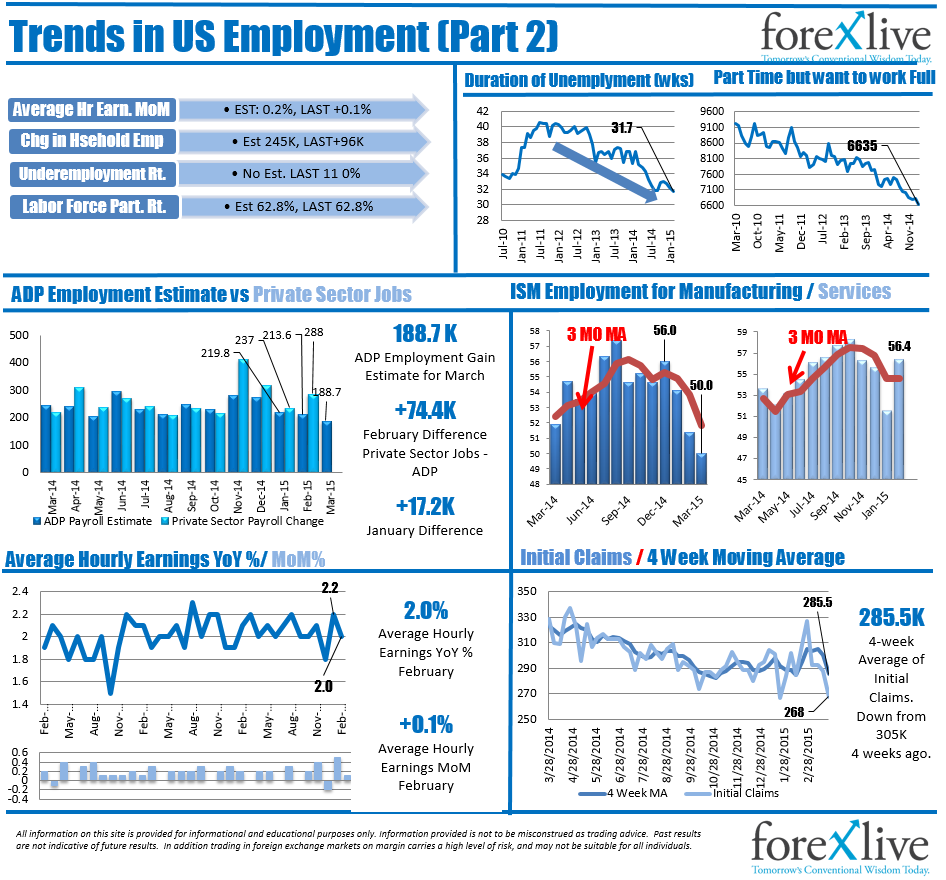

- The average hourly earnings are expected to rise by 0.2% vs. 0.1% last month

- The participation rate is expected to remain steady at 62.8%

Something < 225k will likely lead to US dollar selling. A gain >275K will likely send the dollar higher. If the number comes in at 250K it is anyone's guess but I would expect up and down volatility - with a move higher over time.

With Europe closed for the Good Friday holiday (and the US stock market also closed . The bond market is recommending a 12 PM ET close), the potential exists for volatile action if the data comes out materially weaker or stronger than expectations.

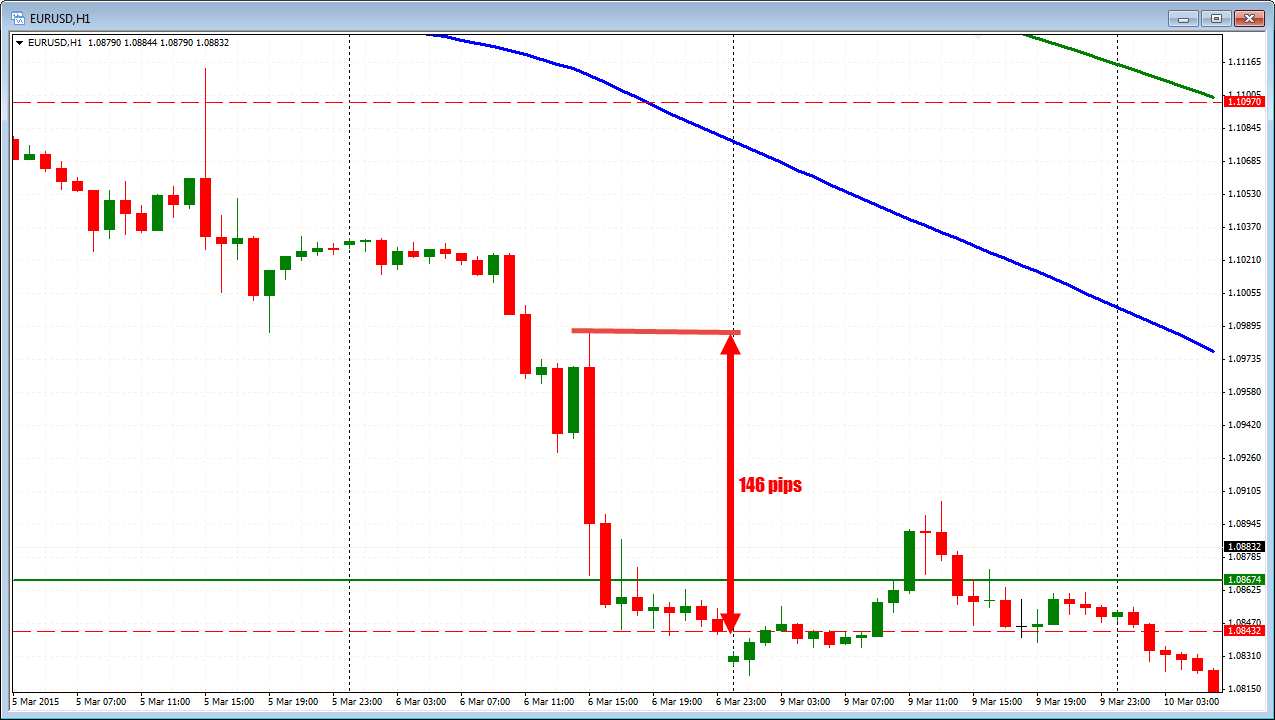

Last month at this time, the market was preparing for a weak number. The Initial Claims data was a bit higher. The ISM employment component had fallen. ADP was weaker than expectations as jobs were shed in the oil industry. The weather was ice cold in February. The actual number defied the signals and came out stronger (295K vs 235K estimate). The price of the EURUSD tumbled 146 pips to a low at 108.43 (see chart below).

This month, the ADP is once again weak (does it matter as it tends to run low and can be off by a lot at times). The ISM Manufacturing employment was even lower (does it matter - the US is a service economy and a stronger dollar is not helping manufacturing). On the plus side, the initial claims are better, and there seems to be an underlying momentum in the jobs picture. The price is not that far from the closing level after the employment report (currently at 1.0875).

So we once again go in with estimates just below the trend average of 260K (Est. 245K), but with that feeling that "it must finally be weaker".

Will it though?