I must have missed something good happening in Europe overnight as EUR/USD is up nearly 170 pips from yesterday’s bottom to today’s top. Of course, none of this is being driven from the euro side, it’s all about the dollar.

It’s probably about time we had a bounce in the euro but it’s hard to get overly keen on seeing a big bounce. and the bears won’t be overly concerned as we’re still 300 pips from the first major fib of the 1.40 fall.

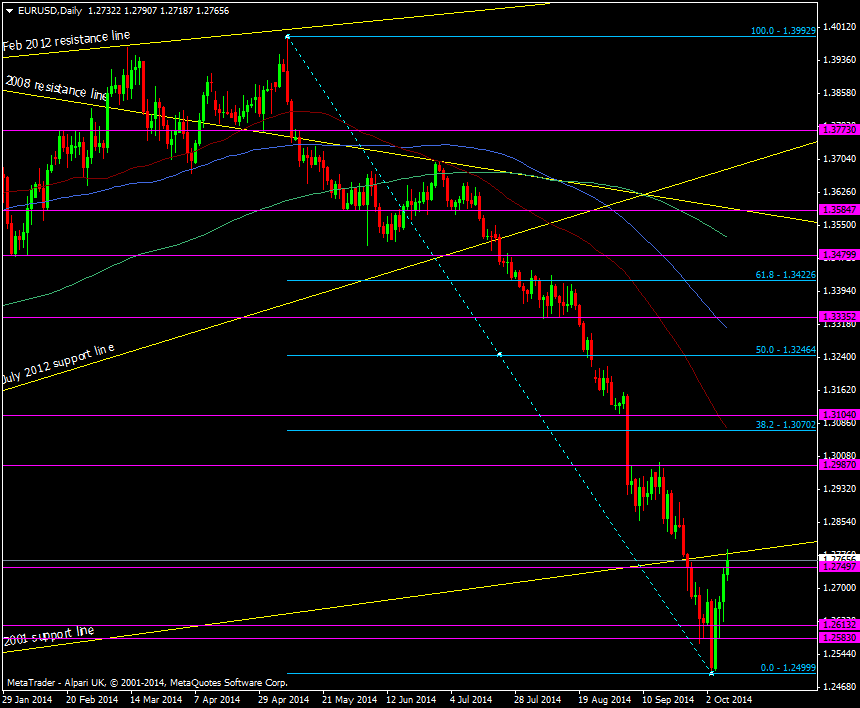

EUR/USD Daily chart 09 10 2014

We’ve not been able to make inroads above the 2001 support line and the price will need to get above and hold it for it to become support. If we do break up further then 1.28 is the where we’ll find resistance next and then 1.2815/25 and 1.2860/65.

We held for a while at resistance at 1.2750 and this will now be main support as well as 1.2700. Minor support should be seen at 1.2715/20 also.

It looks like the market got itself all worked up again into the FOMC. I don’t have any faith still in euro buying so I shorted USD/CAD just before the release, as I suggested yesterday. I took that off the table late last night and will now be looking to see if we get further dollar weakness to buy into.

The FOMC might not have been as hawkish as the market wanted (yet again) but much like the Bank of England, rate rises are coming and that’s going to push the dollar back up. Sentiment is pushing rate expectations further back but I’m not seeing anything major yet that suggests rate rises aren’t coming in at least the first half of next year.