USD/JPY down 84 pips to 109.81 today

Societe Generale Research discusses the ongoing move lower in USD/JPY.

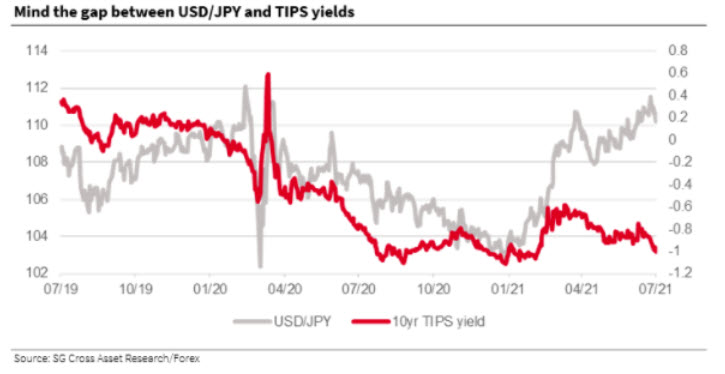

"The yen is, after a period of ignoring the fall in US real yields, coming home to them with a bang. The chart shows 10yr TIPS and USD/JPY, which has been very hard to understand since mid-April. Q3 is starting on a much sounder footing. The caveat is that the fall in longer-dated US yields at the start of April saw USD/JPY fall from 111 to 107.50, before the largely unintelligible rally back to 111.60,' SocGen notes.

"This could be a false dawn especially if TIPS yields turn higher and market volatility leaches away again. But that's unlikely with Covid concerns, more volatile oil prices, a debate about growth peaking, and with central bank policies diverging," SocGen adds.