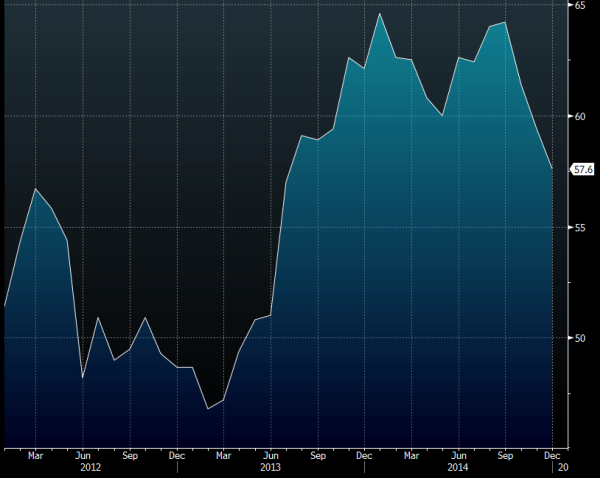

- Prior 59.4

- New orders 54.7 vs 56.3

Lowest since July 2013

Civil engineering was the biggest mover as output fell for the first time since May 2013. Housing is still growing but has slowed to the slowest since June 2013.

GBP/USD virtually unchanged at 1.5300 as construction continues to level off from the highs reached in 2014. The skills shortage is still being highlighted by respondents but the increased costs of subcontracting skilled workers is being offset now by the lower commodity costs, as noted by David Noble at CIPS;

“The sector is still expanding with the index posting at a higher level than the longer-term average, and led primarily by residential development – but it has become a victim of its own success as it struggles to keep up with its own speed of recovery. With increases in new business, comes pressures on the availability of talented staff and a squeeze on the performance of supply chains. “Still replacing the skills lost in the recession and faced with increasing charges for the sub-contractors used to fill in the shortfall, the sector is enjoying lower commodity prices to balance out costs. As more new business comes in, so vendor performance is being affected and key raw material delivery times are lengthening.”