Credit Agricole don't see any reasonable downside for the pound

At least someone likes the pound ;-)

GBP was under pressure by the end of the week,mainly on the back of the central bank lowering growth and inflation forecasts, and as central bank member McCafferty stopped calling for higher rates.

On the other hand it must be noted that the central bank is keeping longerterm inflation forecasts stable. In fact medium-term inflation expectations as measured by 5Y inflation swaps have not been supporting investors' more muted central bank rate expectations of late. Unless domestic conditions deteriorate more meaningfully this is unlikely to change, regardless of a more challenging outlook for trade.

As such we do not expect next week's production and trade data to have any sustainable currency impact.

Overall we remain of the view that currency downside is limited from current levels, in particular versus currencies such as the EUR.

We stay short EUR/GBP* based on the view that policy expectations have room to diverge.

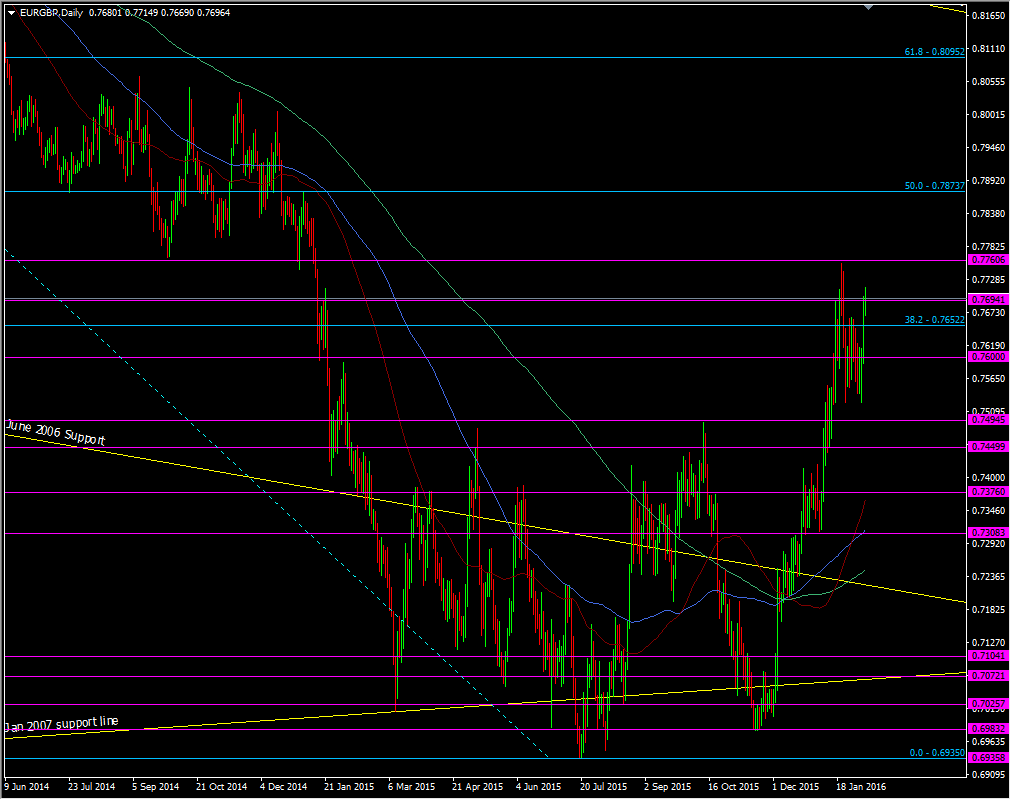

CA are currently short EURGBP at 0.7600 with a stop at 0.7850, and are looking to cash in at 0.7200. At current levels their target is obviously a football field or two away. Looking at my charts the hard work is down at 0.7500, 0.7450, 0.7375/80 and 0.730010. That's a lot to ask of this pair and I think they'll need a very big hand from the data and the BOE to get there.

EURGBP daily chart

Greg's just grabbed the latest cable move, and if it wasn't this late on a Friday I'd be interested in lifting it close to 1.4450. I might do it on the old demo account and see how it fairs, just to see if I can regain some lost pride ;-)

eFX News are the deliverers of this note so why not pay them a visit

I'm going to slide myself away from the action now and I hope you've all had a super week, and hope you have a great weekend. Thanks for coming to ForexLive