Risk increased through report

The July and August employment reports will be key in determining any chance for a Fed tightening. With oil below $45 per barrel and commodities lower (see CRB index below), growth at 2.3% or so, the Fed will have to start seeing future wage inflation - even if that is not showing up either. To anticipate wage inflation though and justify a September liftoff, a decline in the Unemployment rate and/or another 225K or better, with revisions to prior months will be eyed by traders.

As with all employment reports, risk is at an elevated level. No one really knows whether it will be 225K, 325K or 125K. Initial claims have been better but that could be summer. Non Manufacturing ISM was great, but ADP was a disappointment at 185k. Flip a coin.

So that leaves post event levels to give traders a road map.

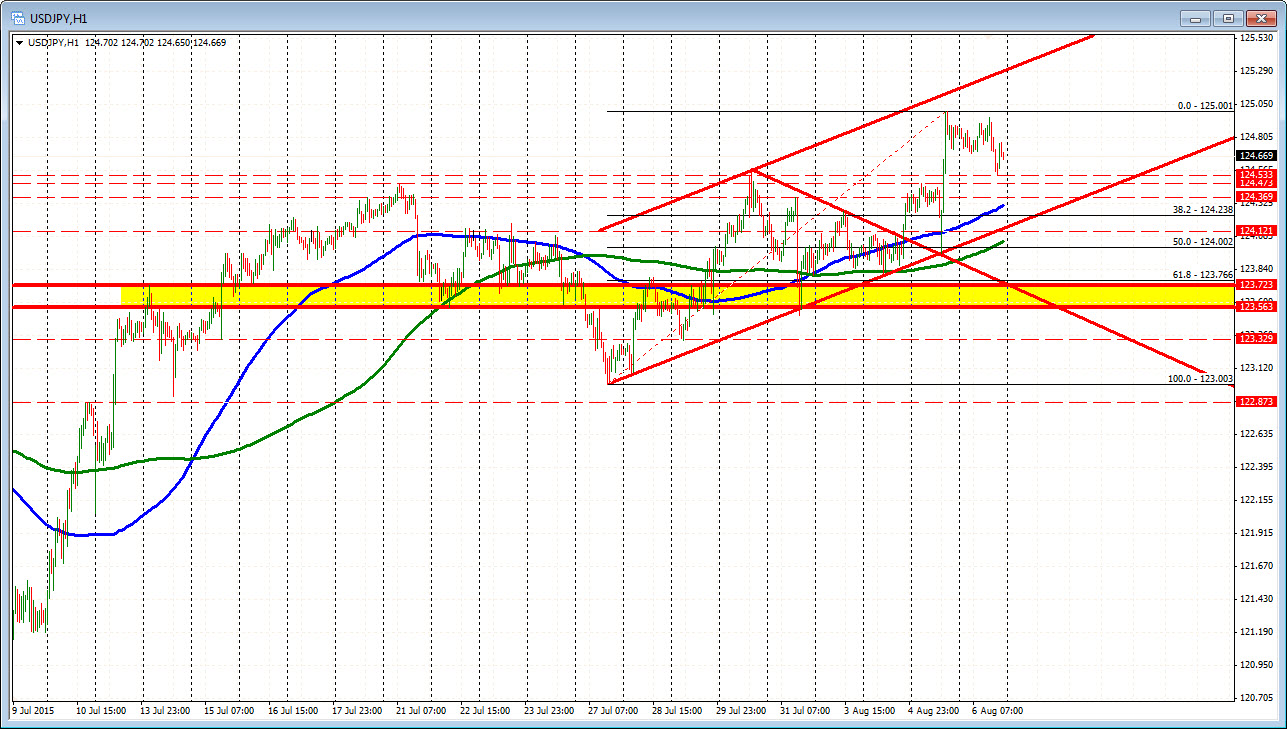

Here are the levels for the USDJPY and why...

On a stronger number (>240K with revisions positive. Unemployment rate at 5.3% or lower, hourly earnings at +0.3% or better)

- 125.04: This was the high from June 2 and will be an easy target to get and stay above

- 125.37: Topside channel trend line on 1 hour chart.

- 125.85: The high for the year. Note 125.79 is the high from Dec 2002 (the last/closest high other than 125.85. So the combination of both opens the upside for the pair

- 125.98: High price from June 13, 2002

A move above that level opens up the upside. Depending on the low reached before the release, a move to the 125.98 level would imply a move of 130-150 pips. That is a doable target but with the 22 day average of around 80 pips currently for the USDJPY it would be be a good move for the day.

On the downside:

- 124.47-53: Low from today and high from Asian-Pacific yesterday

- 124.37 high from July 31. The 100 hour MA will be in that vicinity as well

- 124.12: The 200 hour MA will be in this vicinity at around 8:30 AM

- 124.00: 50% of the move up from the July 27 low

- 123.56-72. Lots of swing lows and highs on hourly chart going back to mid July

- 123.32 low from July 29

- 123.00: low from July 27th

A more bearish number would be something < 200K with negative revisions. Hourly earnings 0.2% or less. Unemployment rate > 5.3%