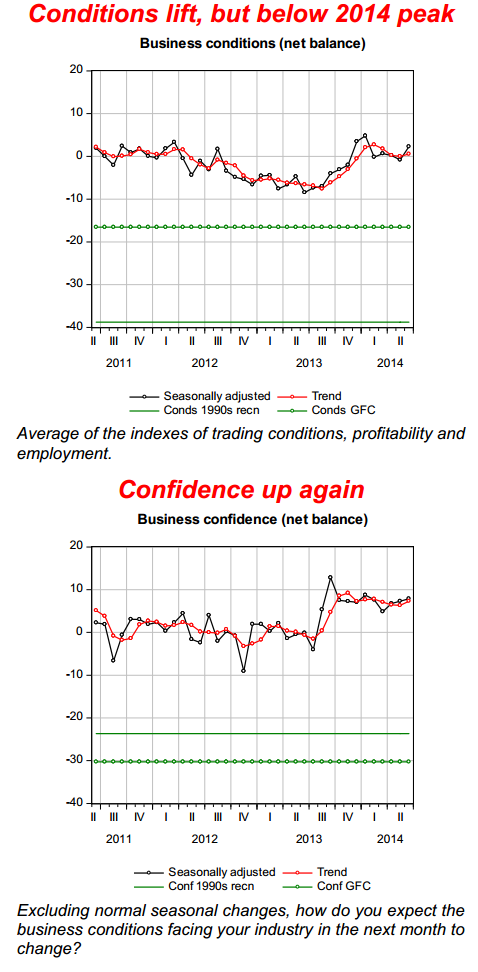

- National Australia Bank business confidence for June: 8 (prior was 7)

- National Australia Bank business conditions for June: 2 (prior was -1) … conditions reached their highest point since January

- Capacity utilization rate 79.3% (lowest since January 2013)

NAB chief economist Alan Oster:

- “Business confidence has remained resilient for the better part of a year despite below average business conditions”

- “Firms are sticking to their expectation for stronger activity despite business conditions remaining below long-run averages and no change to forward orders”

- Construction sector posted the highest level of confidence for the second month – upturn in residential activity

On conditions:

- Conditions remain below their long-term average

- “Looking through monthly volatility, the clear easing trend since the start of the year appears to have bottomed, despite mixed signals for domestic demand”

- Soft conditions in the bellwether industry of wholesale suggest little momentum for domestic demand in the near term

- Conditions improved for all industries

- Service industries remaining the best performer

- Construction “surging”

- Wholesale & manufacturing weakest

- Oster cited low interest rates, a “somewhat” improving global environment … generated pockets of strength, notably in residential construction

- “Sales and profits are stronger, but employment is yet to respond”

- NAB’s wholesale leading indicator suggests weak underlying conditions, pointing to further below-trend growth in the second quarter and little near-term improvement in demand … inflation remains benign

NAB leaves its main forecasts unchanged:

- Unemployment still expected to reach 6.25% by late 2014

- RBA interest rates expected to stay on hold until late 2015

–

–

So, while consumer confidence in Australia is still on the weak side, post-budget, business confidence is bouncing back. The AUD has liked it, testing toward the figure (0.9400), but the selling has been enough to hold for the time being. orderboard here. Note, stops above 00/05 are going to become tempting I would think.