Preview of all the numbers that matter ahead of the July 2015 Non-farm payrolls and employment report

We're back to Friday's after the US holiday last month and here's how we stand currently

- Median NFP estimate 225k (212k Private)

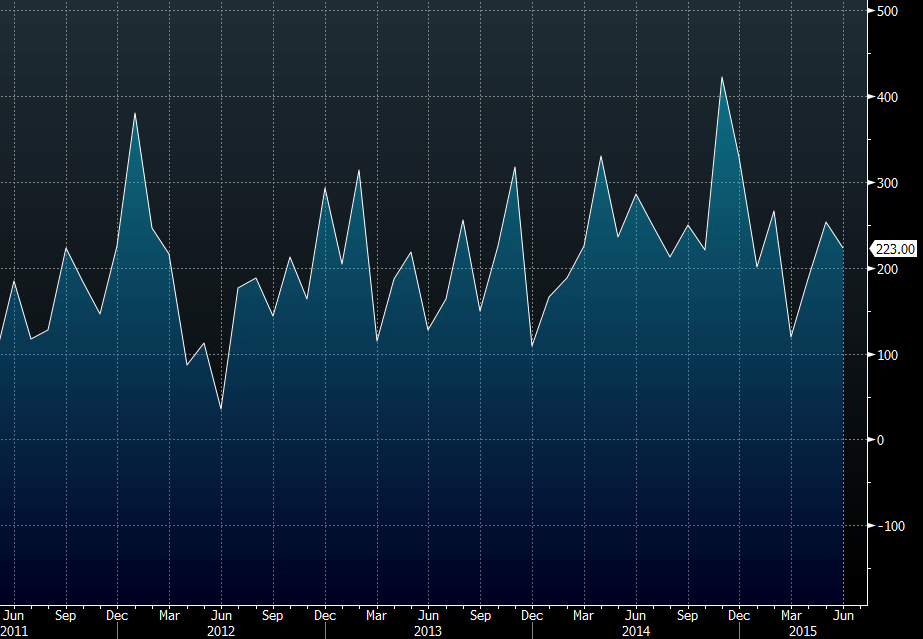

- June 223k

- Highest estimate 310k (LinkUp)

- Lowest estimate 140k (Berliner Sparkasse)

- Average estimate 222k

- Standard deviation 22k

- Unemployment rate exp 5.3% unch

- Participation rate exp 62.6% unch

- Avg hourly earnings m/m exp 0.2% vs 0.0% prior

- Y/Y exp 2.3% vs 2.0% prior

- Avg weekly hours exp 34.5 unch

Here's the July jobs story so far

- ADP 185k vs 237k prior (exp 215k)

- ISM manufacturing employment 52.7 vs 55.5 prior

- ISM non-manufacturing employment 59.6 vs 52.7 prior

- Initial jobless claims 4 wk avg 282.5 vs 273k prior (for June/July NFP survey date)

- Consumer confidence jobs hard to get 26.7 vs 26.1 prior

- Conference board help wanted online demand for hiring +83.7k vs -114.3k prior

- Challenger layoffs 105.6k vs 44.8k

- Philly Fed employment -0.4 vs +3.8 prior

- Empire State employment 3.19 vs 8.65 prior

- May JOLTS 5363k vs 5376k prior

Non-farm payrolls

As always the earnings data will be important so any lift there will also lift the buck, and the opposite if it's lower.

The ISM non-manufacturing PMI raised a few eyebrows on all fronts and the jump in employment has had some of the market scaling up estimates for the NFP. I mentioned the spike in the initial jobless claims 4 week average earlier but the difference between survey dates doesn't look like it might throw much of a skew, if any at all

Conversely, there was a bit of a shock with the Challenger layoffs coming in very high and that's had some thinking about a lower NFP

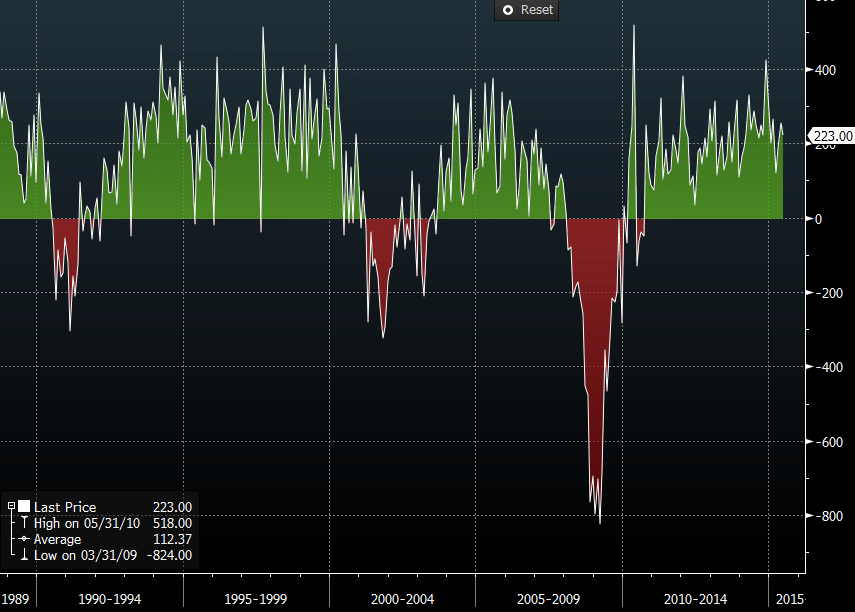

Employment has been looked mildly softer in most of the indicators and there's always a risk that the strong run in NFP's ends at some point. It's hard to go against the trend right now though with payrolls going on their longest positive run for many years

Long run NFP