Its been a good couple of days from China PMI data:

- Sunday: China official PMIs (March): Manufacturing 50.5 (vs. expected 49.6), Services 54.8 (54.0)

- Monday: China - Caixin Markit Manufacturing PMI for March 50.8 (expected 50.0)

Japan, too, not quite as good but better:

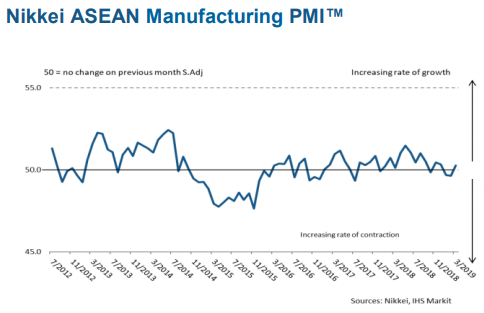

Markit also collate PMI readings from smaller Asian economies, into the ASEAN Manufacturing PMI

- based on survey data collected from a representative panel of around 2100 manufacturing firms

- National data are included for Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam (together these countries account for an estimated 98% of ASEAN manufacturing activity)

This PMI moved up into growth in March, at 50.3

- from 49.6 in February

David Owen, Economist at IHS Markit:

- "The ASEAN Manufacturing PMI crept back above the 50.0 mark in March, signalling the first improvement in operating conditions this year. The survey found that a slight rise in sales and production growth lifted business sentiment. Nevertheless, this still left the average PMI reading for the quarter at its lowest since Q4 2016.

- On the other hand, manufacturers will be encouraged by reports of even softer cost pressures in March. The rate of input price inflation dropped to a record low, as material prices remained subdued compared to last year. Naturally, this should help companies manage their balance sheets in this particularly difficult period."