Due at 2245, a quick heads up what to expect

via Westpac, bolding mine:

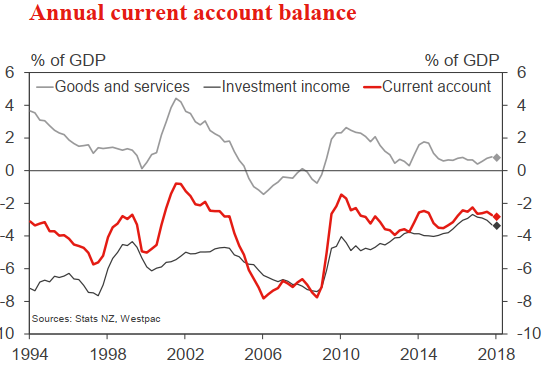

- We expect the annual current account deficit to widen slightly to 2.8% of GDP. While goods imports remained firm, New Zealand's export performance worsened in the first quarter due to a drop in both prices and volumes. This decline is likely to be short-lived: commodity prices have since improved, and we suspect that the drop in volumes was due to the timing of shipments.

- We expect a slight narrowing of the investment income deficit for the March quarter, with a pullback in profits of overseas-owned firms after a few unusually strong quarters. However, the deficit is still likely to be larger than it was a year ago, contributing to a widening of the annual current account deficit.