The New Zealand Institute of Economic Research Quarterly Survey of Business Opinion

(AKA NZIER QSBO for the alphabet soup fans)

For the second quarter of 2018:

- Business confidence -20 vs -11 previously

- Capacity utilisation 92.8% vs. 93.5% prior quarter

Business confidence to a 7 year low

The measure of domestic trading (see below, it fell from 15 to 7) is at its lowest since Q1 of 2013

This survey is a poor result. One positive to emerge though is firms intend to increase hiring (mainly services sector)

More, comments from NZIER:

net 19 percent of businesses expect a deterioration in economic conditions - more pessimistic than the 10 percent in the previous quarter

Continuing the recent trend, firms' views on their own trading activity - a good indicator of economic growth - remained more positive.

- Domestic trading activity in the June quarter still softened, however, with the proportion of businesses reporting higher demand decreasing from 15 to 7 percent.

- Firms' expectations of future demand also eased, with fewer businesses expecting improved demand over the next quarter.

These developments point to softer economic growth in the second half of 2018.

Weak profitability was a feature across most sectors

Weak business confidence and deteriorating profitability is making businesses more cautious about planning for the future.

Although hiring is holding up across most sectors, investment intentions have declined.

---

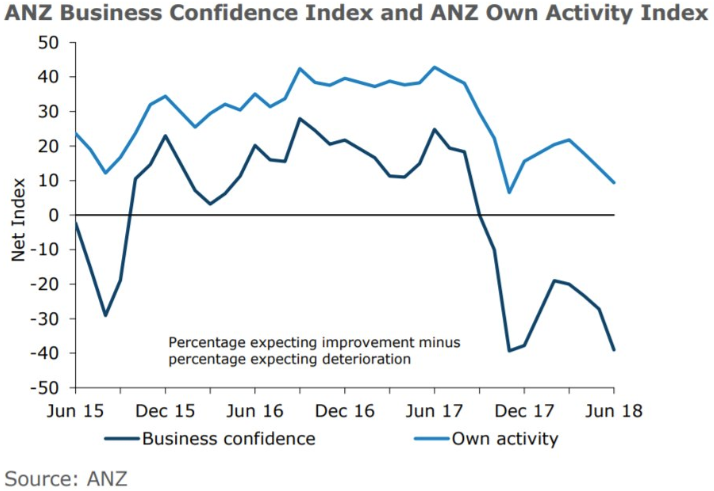

This result follows recent soft business confidence readings from other surveys

This from ANZ, for example:

Keep an eye on jobs and inflation data in NZ … if indicators for these begin to fall a potential RBNZ rate cut will swing into the spotlight