WTI crude down 77-cents to $42.16

Oil prices are carving out fresh session lows after crude below support. The October low of $$42.58 gave way and that's added selling pressure on oil.

The main event today is the US weekly inventory report from the EIA. It was delayed a day from the usual Wed release because of the Veteran's Day holiday.

The market is expecting a large build after API reported a 6.3 million barrel increase on Tuesday. The consensus estimates are +790K (BBG) and +1.0 million (RTRS) but the market will be expecting at least a 4 million barrel build.

OPEC tries some jawboning

These are desperate times from some OPEC members. Government spending swelled under high oil prices and with crude back in the $40s, the party is over. They've leaned on the Saudis to cut production but Saudi Arabia hasn't blinked (and won't after they tapped the bond market to fund their own needs).

In today's OPEC monthly report they tried to call an expected 130K decline in non-OPEC supply next year a 'gaping supply hole'. Nevermind the gigantic supplies that have built up in storage and that global production will still be in a 560K bpd surplus next year. Or that Iran will do everything it can to flood the market.

What's next

Oil is oversupplied by at least 1.5 million barrels per day and storage facilities are nearly maxed out. US supplies traditionally build from now through April and we're an order of magnitude above traditional storage peaks already.

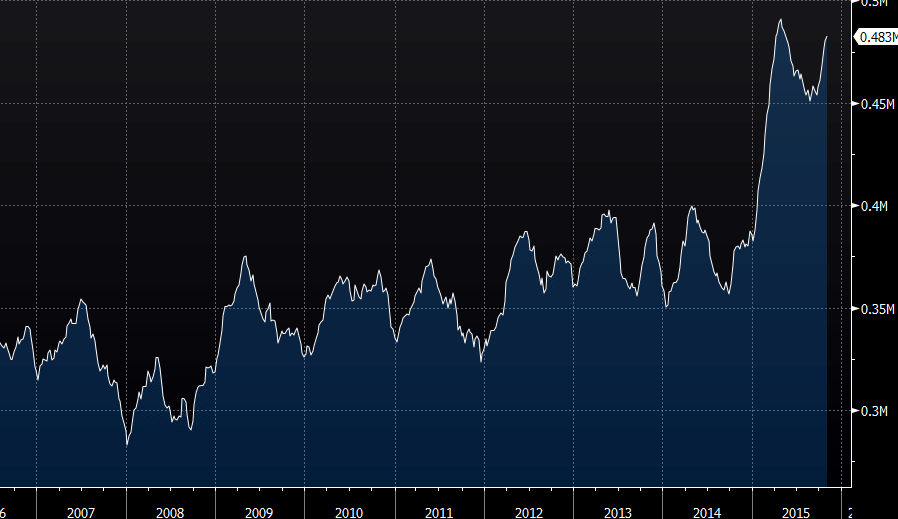

Total US oil supplies (1000 barrels)

With total storage at 483 million barrels and last season's peak at 492 million barrels, it will only take a few weeks for supplies in storage to hit all times highs.

Other than hope or fanciful predictions about 'gaping supply holes', I haven't heard a semi-coherent argument for why oil prices should rise any time soon.

I suggested USD/CAD longs yesterday and I believe the pair has much further room to run as oil prices tumble.