As I’ve pointed out before it’s pretty much a given that rates are going up next year, unless something derails the economy big time. One thing that has the potential to do some damage to the pound is politics and the general election next year.

Mike gave us the details about UKIP’s win and politics are going to be playing a big part of trading the pound next year. In between we’ll be getting the odd by-election which may have some effect on the quid but we won’t really start getting into it until the new year when the campaign wagons get cranked up.

Cable is off nearly 200 pips since yesterday’s highs and the election news might be aiding that fall. The rest just looks like doom and gloom on growth worries as it’s not part of overall dollar strength.

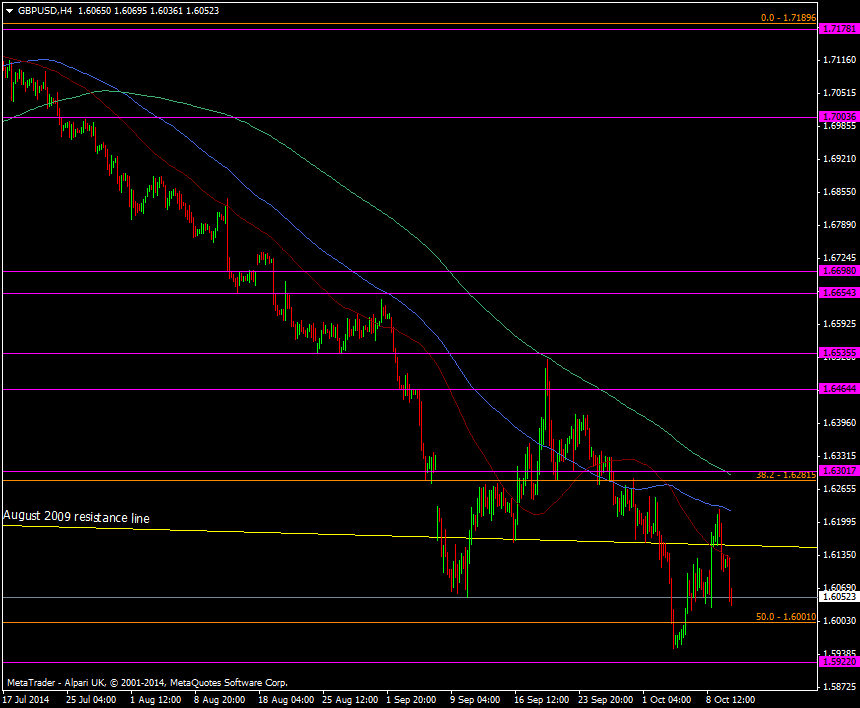

We’ve rebounded from closing below the 200 wma at 1.6007 last week and the level may have a says in this week’s close too.

GBP/USD H4 chart 10 10 2014

Support is coming in between 1.6025/30, ahead of 1.60 but the bigger support line is at the 1.5950 lows. I’m sitting on the fence a bit with direction in the pound at the moment. There’s a lot being chewed through by the markets on both sides of the pond and until we start getting a clear direction or find a decent range, I’m likely to stay on the sidelines with this pair.

We’re light on data again today and there are a few more talking heads in the US session to watch out for