PCE report preview

The April personal consumption expenditure report is due on Tuesday, May 30 at 8:30 am ET (1230 GMT). The report has some important numbers on personal income and personal spending but it's also the Fed's preferred measure of inflation -- the PCE deflator. The recent downtick in prices has caught the Fed off guard and threatens to derail a June 14 FOMC hike. That's why Tuesday's report is so huge.

Here are three things to watch for:

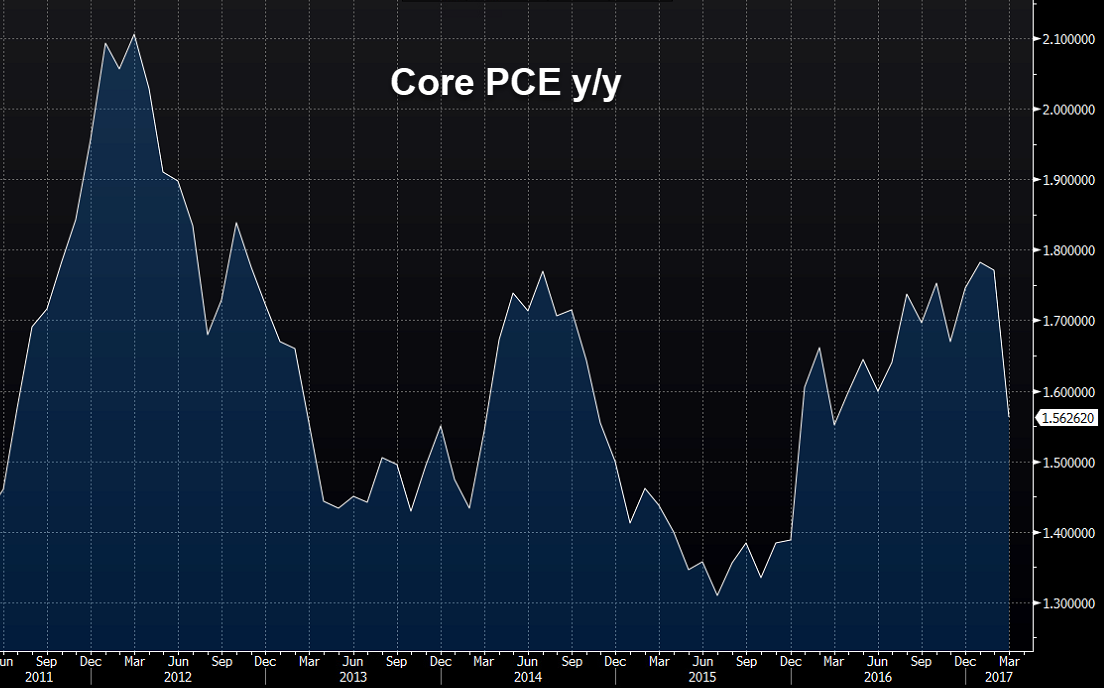

1) Core PCE y/y

The Fed's mandate is to manage all inflation but core is what it watches most closely because it strips out superfluous and one-off skews to show the broader trend. The core year-over-year reading was gently accelerating in 2016 and through the start of 2017 but in March it rolled over. Another low reading in April will give the Fed plenty to think about.

The consensus estimate is 1.5%.

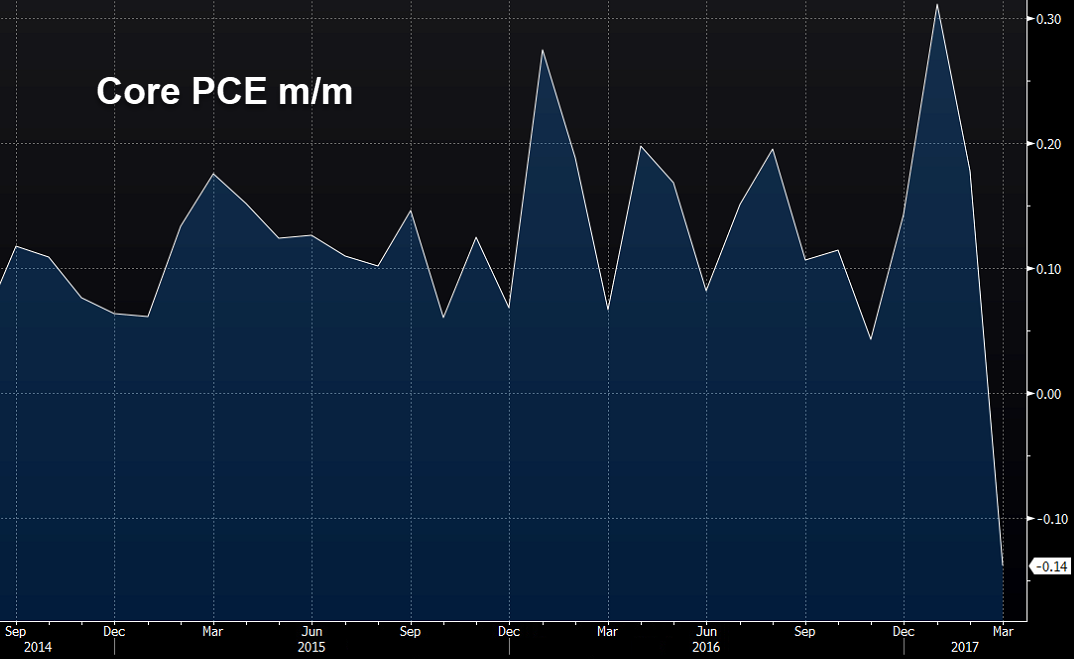

2) Core PCE m/m

A weakness of year-over-year inflation numbers is they can be skewed by revisions and the drop-off from skews in the prior year. That's why the month-over-month numbers are also critical. In March, core prices fell 0.1% (or 0.14% rounded to second decimal). The Fed wants to see at least 0.2% price growth each month.

The consensus is +0.1%.

Personal income

The Fed, the White House and almost everyone else wants to see US wage growth. It's been elusive since the crisis as offshoring, technology, the decline of organized labor, regulation, healthcare costs and a multitude of other factors keep pay low.

Until it appears, there is no real pressure on the Fed to hike. The rate moves so far have been about taking a bit of risk out of the system, creating some breathing room and getting ahead of potential wage inflation. But what if that inflation never comes? It's a legitimate worry.

The consensus estimate is for a health +0.4% m/m rise in April after a +0.2% rise in March.