The RBNZ decision is due at 2000 GMT (3 pm ET)

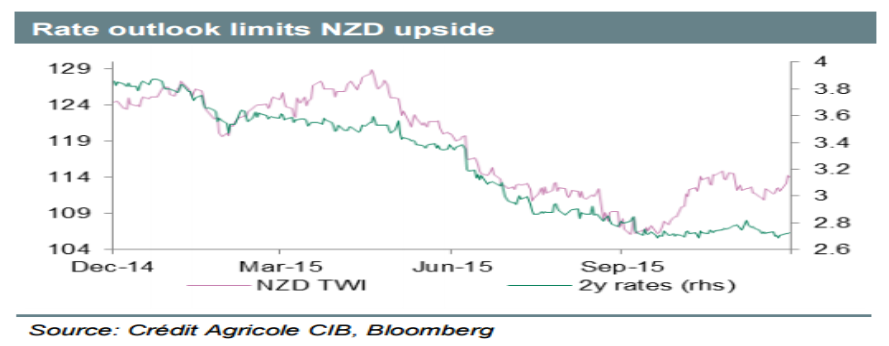

Considering the RBNZ's cautious stance with respect to price developments and as the currency's recent appreciation is likely dampening inflation it should come as no surprise that a rate cut will be strongly considered this week.

It must be remembered too that the central bank already indicated previously that a dampened medium-term inflation outlook would require a lower interest rate path. Taking into consideration that markets price in a merely 50% chance of the RBNZ easing monetary policy, such prospects should trigger further currency downside.

Elsewhere, risk sentiment should deteriorate further, mainly on the back of strongly limited liquidity expectations. Given the ECB failing to make a case of further rising liquidity expectations and as the Fed remains on track to consider higher rates in December, we believe that investors' appetite for risk assets will stay low.