US retail sales due at the bottom of the hour

The line to watch in the US retail sales report is the 'control group'. That excludes the volatile components of autos, gasoline and building materials and is largely what will drive the market reaction. It's expected to rise 0.4% m/m in October.

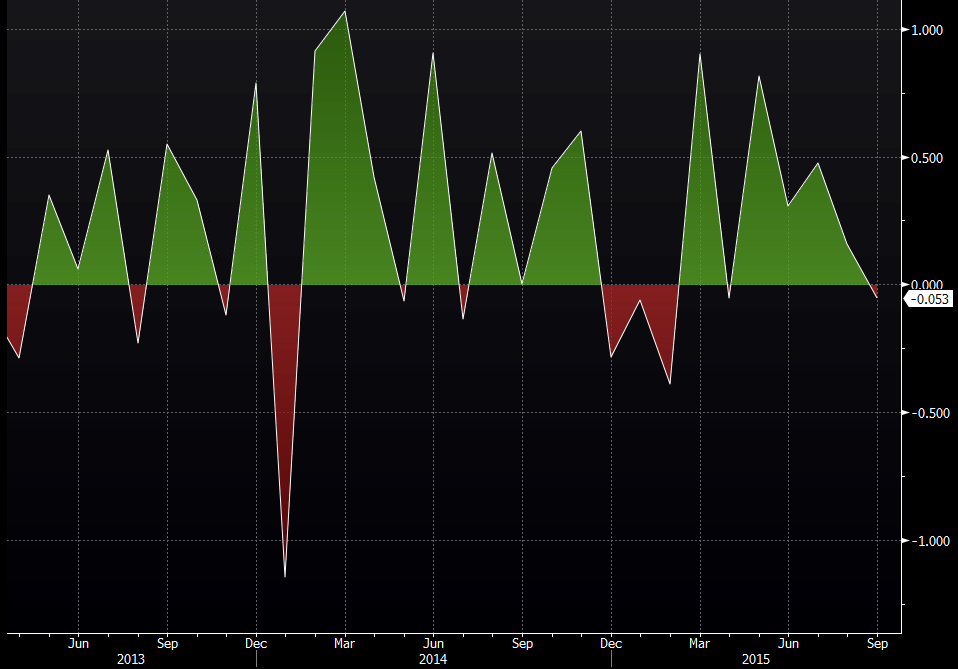

Also watch for a revision to the 0.1% contraction in September. The unrounded number was -0.053%, so it will only take a tiny revision higher for to tick to unchanged.

October isn't a particularly important month for retail sales but a strong report combined with the great October jobs data would point to a US economy that's accelerating and might give the Fed a final nudge towards a December hike.

At the moment, market pricing suggests a 66% probability of a hike while 92% of economists in a survey released yesterday expect a hike.

I think the past few days of US dollar retracement have been a standard consolidation ahead of a larger push in the coming weeks. If sales are strong, it's time to get on the USD train and hang on for the ride.