US futures lower, same as Treasury yields

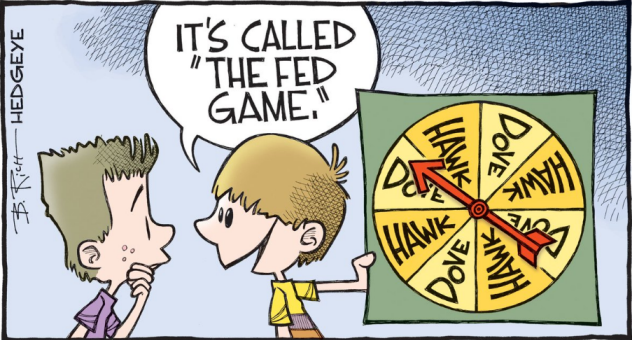

The focus this week will turn towards the Fed meeting on Wednesday, month-end trading, and a host of big tech earnings as well, so those will be key risk events to be wary about over the next few days.

The former will arguably be the main one to watch but for now, the market is still somewhat sitting on the fence. Equities are a touch softer are having hit record highs last week while 10-year yields are still holding below 1.30%.

The bond market remains a key spot to pay attention to and the reaction to the Fed meeting this week will set the tone for how to proceed in the weeks ahead.

MUFG argues that the Fed needs to push back a bit against recent market developments and present a more optimistic outlook, which shows that the economy has a "decent runway" as the central bank lays the groundwork towards tapering:

"That's the right message and the positive spin that the Fed can deliver, which would then stop these unabated, non-stop rallies."

Morgan Stanley also chimes in by saying that the meeting could be an important catalyst for helping to push yields higher in the aftermath:

"An upbeat assessment from the Fed and continued discussion of tapering could ring hawkish to the market."

But not everyone sees it that way, with Jefferies' analysts arguing that:

"If anything, the tone of the FOMC statement and press conference is likely to be incrementally more dovish than June given the renewed health concerns."

Care to spin the wheel?