That old saying has served many well previously but over the last few years of the crisis it’s not been applicable.

For a while now we’ve been suffering from a lack of liquidity which has seen volumes tumble in FX.

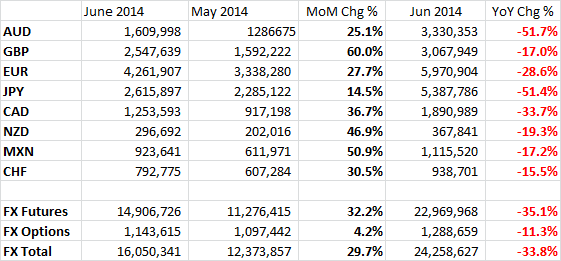

Better news has been reported by the CME who say that Forex volumes rose 32.2% in June m/m, with the pound leading the way (Where have you heard that before?

)

Trading in Her Majesty’s quid was up 60.0% on the month against the dollar with the next highest increase in MXN +50.9%. Trading in the euro was up 27.7%

Despite the good increases in the monthly numbers the year on year numbers tell the whole story we are currently seeing with volumes down 35.1% compared to 2013. The aussie and the yen fared the worst dropping 51.7% and 51.4% respectively.

June 2014, CME FX Trading Volumes

There’s been many reasons touted for the fall in volumes for example, the ongoing FX manipulations and tougher regulations on bank business, but I think it’s more than that.

We have come off an unprecedented amount of volatility that came with the crisis so it’s only natural that we enter a period of calm and consolidation. We’re passed the major hurdles that threatened to collapse whole countries and continents and so there is an element of relief in markets.

Volumes and volatility will come back at some point. Nothing lasts forever and I’m sure they’ll be some crisis or event that will get our trading screens burning up again. Until then we’ll just have to learn to adapt to our surroundings and trade accordingly.

It’s definitely something that’s worth factoring into your trading plans when setting targets and stops. Be realistic, you’re not going to get a 1000 pip move in a couple of weeks in the current climate. Big levels are even more important as traders won’t want to be caught the wrong side of them as it might be a long wait to get back.

Today’s 50 pip moves are yesterday’s 100 pip moves so ask yourself are you really being sensible going for those extra few pips?