Higher than expected build and more than API yet oil has jumped nearly $2

I usually get the oil price moves on inventory data. Adding it all up with expectations and which way the market is leaning.

Based on the API data, which matched the BBG expectations more or less, the bigger than expected build should have seen a drop in the price, maybe 50 cents or so, then a possible rebound as the market fades that. A two buck jump though? I'm not an oil expert in any way shape or form but that smells fishy in my book.

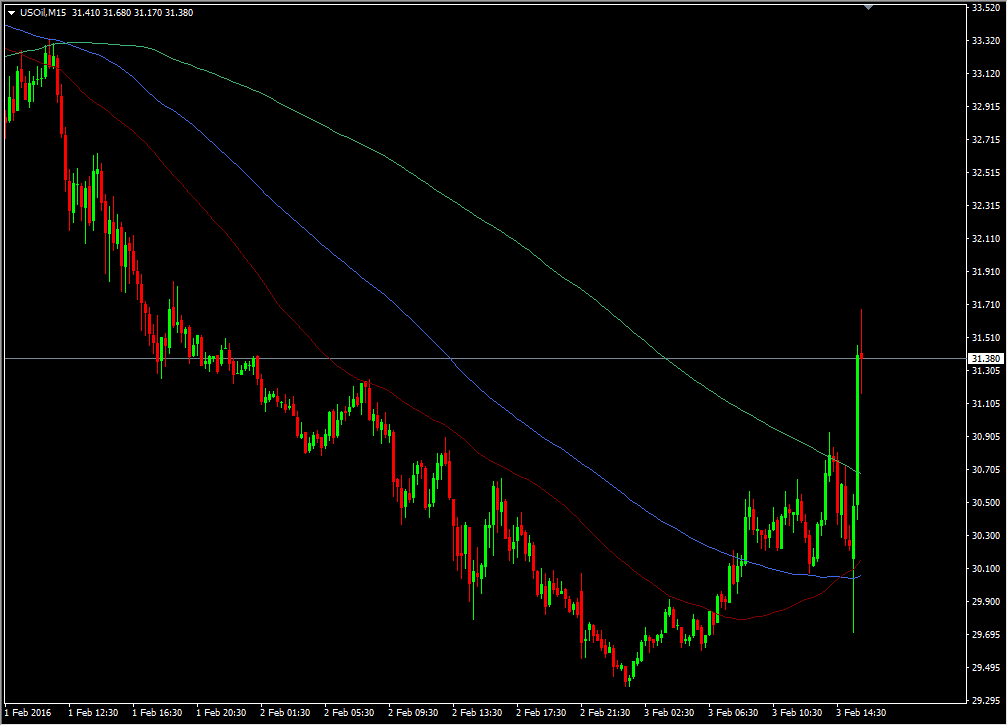

WTI 15m chart

Maybe there's a headline I've missed but there nothing I've seen that's been out today that suggests oil needs to bounce like that.