BoAML asks: “Where To Target The Corrections In EUR/USD, USD/JPY, Gold?” in this from eFX:

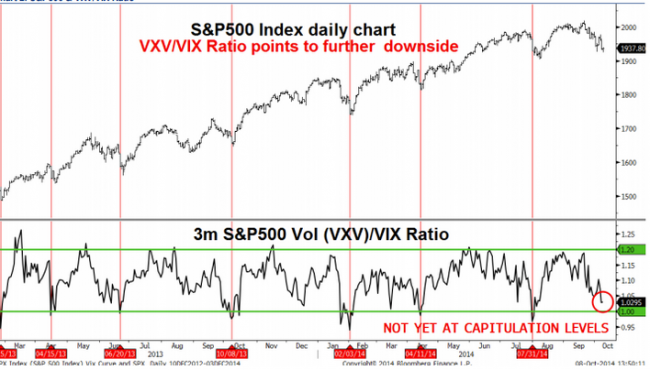

The VXV/VIX ratio is fast approaching levels that indicate market capitulation and often coincide with tradable low, notes Bank of America Merrill Lynch.

In such an environment, according bofA, US Treasury yields should continue to decline with 30yr yields are fast approaching critical long term resistance at 2.986%, while the US dollar should remain in a consolidation Correction mode especially against Gold, the EUR, and JPY.

“With the USD looking a bit vulnerable against several currency pairs, gold bears should beware,” BofA warns.

“The yellow metal could correct higher in the sessions ahead to 1241 before the larger downtrend resumes for 1180 and below,” BofA adds

“The USD is showing signs of correcting lower against both the EUR and JPY. EUR/USD can rally to 1.2850/1.3000, while USD/JPY can extend lower into 107.63/106.85,” BofA projects.

“However, USD weakness should be seen as a buying opportunity,” BofA advises.