Is the EURUSD finding quiet buyers in the quiet market? Sifting through some clues.

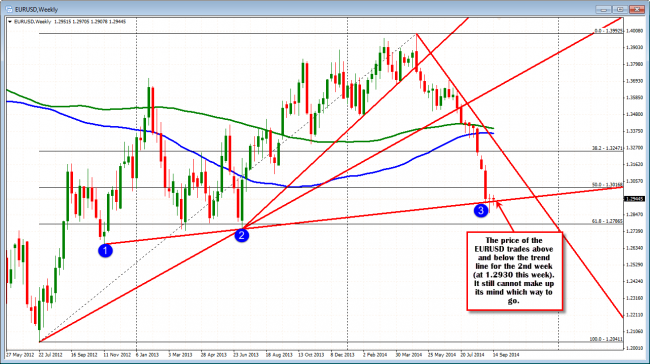

The EURUSD has traded above and below the trend line for the second week in a row on the weekly chart (see chart below). The level this week comes in at 1.2930. The market is still unsure as to the next directional move. This is highlighted by the narrow 127 pip trading range over the last 8 trading days now (since the day after the ECB rate cut). Intraday ranges are ok. With the exception of today and last Thursday the low to high trading ranges are above the average over the last month or so of trading. However, the price is not going anywhere. We are above 1.2930 though (small bullish?)

EURUSD on a weekly chart shows the pair consolidating above and below a trend line at the 1.2930 level. The market can not decide on the next move yet.

Eventually, traders will make the break. So I will be keeping my eye out for any clues from the charts and look for momentum.

Looking at the hourly chart today, the price low today, fell below the 100 hour MA on the downside (blue line at 1.2932) to a low of 1.2921. That break was short lived with only one hourly bar closing below the level. The last two trading days has lows at 1.2908. Holding above those lows and quickly rebounding back above the 100 hour MA may be indicative of perhaps a better buying environment in the market.

The price for the pair is also starting the NY trading day above the 200 hour MAs (green lines) at 1.2939. If the 100 and 200 hour MAs can hold in early trading, it should solicit more buying interest and an extension to the upside in trading today.

The low to high trading range so far is only 46 pips. The average over the last 22 trading days is 67 pips (about a month of trading). So there is room to roam to make a new extension. If the price moves back below these moving averages (risk), I would be less encouraged. Remember, I am not in love with either side as “the market” – through the price action – is showing it is not in love with either side as well over the last 8 trading days. I listen to the market. Having said, my bias right now is more positive for the above reasons.

EURUSD has a higher low (vs last two days) and is above the 100 and 200 hour MA (blue and green lines). Are the buyers showing their hand?

At some point the price for the pair will break. It is logical to think it might be later this week, but it is the unexpected that often moves the market the most. So keep your eyes open (don’t fall asleep). Give the NY market a chance to ignite a spark for a move. If the 1.2975 area is broken a move toward the 1.3000-08 area (50% retracement) would be the target. I would expect sellers in that area though. Remember the 50% of the move up from the 2012 low to the 2014 high comes in at 1.30168 and if the sellers want to remain in control, they should keep a lid on the pair against this level.

It seems like there may be quiet support buyers from what I see. I don’t want to risk a lot on it as neither side is impressing, but let’s see what NY wants and can do….